A 21-year-old student has been on a rather long (4 year) shopping spree after Westpac Bank (Australia) gave her an ‘unlimited’ overdraft aged 17, like all intelligent people she spent almost $3.3million on designer handbags and kept it a secret from everyone.

When the authorities finally noticed she applied for an emergency Malaysian passport and tried to leave the country, only to be picked up at Sydney airport when trying to fly to Malaysia, she was arrested for “dishonestly obtaining financial advantage by deception and knowingly dealing with the proceeds of crime”.

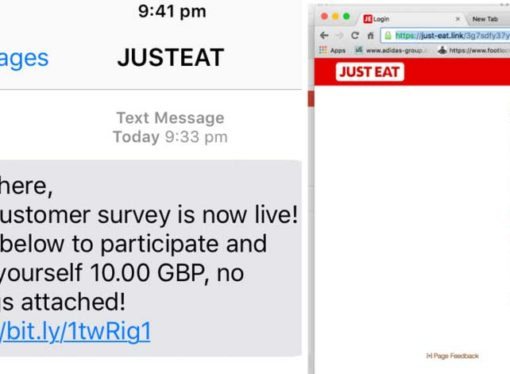

Boyfriend explaining to the press what happened

However, it seems the Police are having a bit of a hard time actually charging her with anything as they stated:

“She didn’t take it from them. They gave it to her.”

Her boyfriend, Vincent King, who tried to pay a $1000 bond for her release, told the bail hearing that Christine was a “good girl” and told reporters “I had no idea”. Bond was granted but Vincent failed to meet conditions, a date in June has been set for a trial.

Addressing the court, magistrate Lisa Stapleton said that if she was given the overdraft by the bank, then no crime took place.

“It isn’t proceeds of crime. It’s money we all dream of,” she said. “She didn’t take it from them. They gave it to her.”

Though she might not have committed a crime, she will still owe the bank the money, though it’s unclear how they’d be able to claw that amount of money back from Christina.

![Guy tricks an Army Veteran for two days (good deed) [Video]](https://10ways.com/wp-content/uploads/2015/11/veteran-100x100.jpg)