The Facts:

- Up to 2,500 Britons are victims of fraud at ATMs every week

- £27.3 million every year is cheated out of British cardholders at cashpoints

- One 93-year old victim had £23,000 taken from him in December 2015 by scammers using a distraction scam

- Card fraud, including telephone scams and cloned cards, is on the increase and together costs banks £479m each year, up 6pc in the period 2013-14.

TL;DR – Things to Remember:

- Never get distracted at a cash point, keep your hands on the cash area & on the card slot. Always check your card is your card when you take it out of the machine

- Always keep a copy of your bank’s emergency phone number on your phone

- If your card or cash doesn’t come out of the cash point then ring your bank IMMEDIATELY and report it / cancel the card

- Cover your pin (even from above)

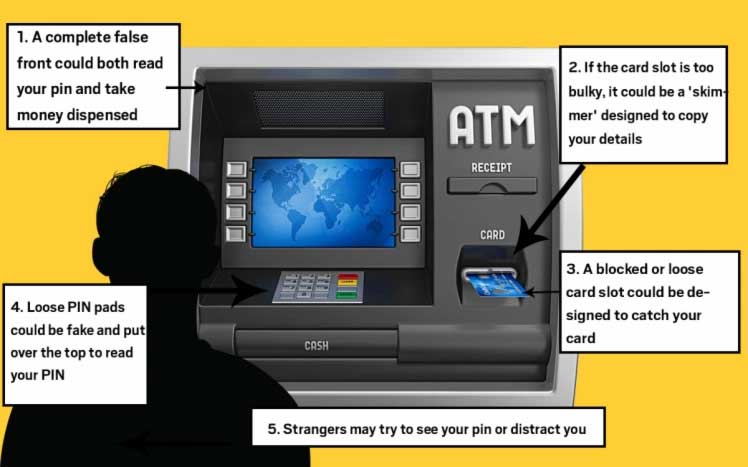

- Check the card machine:

- slot for something that could skim your card or collect your cash

- for any locations that could hold a camera

- a device over the pin pad

- If you suspect a dodgy cash point then ring the Police immediately

What is likely to happen?

Distraction Switch:

It’s very simple really, “Excuse me is that your £5 note on the floor”, you look at the floor and Boom! someone on your other side has just swapped your card as it exited the card machine. You take the fake card from the machine and put it in your wallet/purse

This is what happened to the 93-year old man at a cashpoint (in a bank) in December.

Lebanese Loop / AKA machine swallowed my card up:

A small device is inserted into the card slot, the card enters the cash machine as normal and you withdraw cash, then the cash machine ejects your card as normal but the small scamming device hooks your card so it’s left partly in the machine aka stuck/swallowed up etc.

The victim then goes into the bank to report it or worst still leaves the machine completely, meanwhile the scammers rush in and remove the device which in turn removes your card from the machine.

Alongside this, someone will have either looked over your shoulder at your pin OR they’ve fitted a small camera to film your pin.

This appears normal but actually it’s a card skimmer that may also stop your card from coming out

Here is the same card skimmer in place on the ATM. You might think it’s rather obvious but to the untrained eye it looks rather normal.

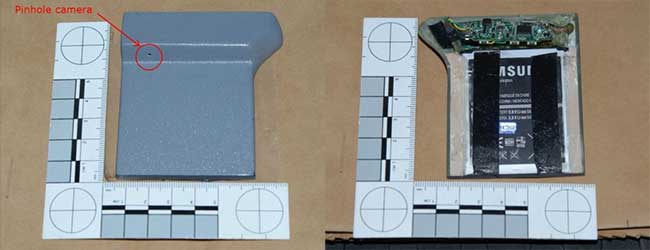

The hidden pin camera

Pretty obvious what this is, a camera videos you entering your pin number.

British Transport Police (BTP) Photos show a pinhole camera disguised as part of a cashpoint casing. The 2nd photo shows the back of the pinhole camera, showing the Samsung battery and circuit board which were hidden from view.

The Free Wifi Skim

Less common due to the sophistication however it’s a real threat. Never enter your card details when on an open/free wifi connection that you don’t trust as anyone can setup a Wifi router remotely and get your keystrokes from your laptop or even the data you send from your phone.

Where is my cash?

Similar to the Lebanese loop but instead of stealing your card they actually steal your cash, a device is fitted over the cash dispenser. You make your transaction as normal but the cash never exits the machine, instead it gets funnelled into a device inserted into the machine. Less common but it does happen. If you don’t get your cash ring your bank immediately.

Fake Pin Pads

Because of people covering the pin pads with hands/wallets etc fraudsters now go to the trouble of making fake ‘mats’ that go over the existing pin pad and memorise your pin.

They just need to nick your handbag, do a distraction switch or use a Lebanese Loop and they’ve got your pin & card.

Video: How exactly do the criminals do it?

DC Mike Dermody, of British Transport Police, said:

“We would urge anyone using ATMs to be vigilant and check for anything suspicious and report it to police immediately, similarly if they see anyone behaving suspiciously around cash machines.

“Skimming devices read card details without the users knowledge and are usually placed in the area where the card is inserted.

“These devices can vary from being extremely sophisticated to very basic, obviously the more sophisticated the device the harder it is to spot so we ask the public to be cautious and if they think something looks out of place then do not use it and as in the recent case at Manchester Piccadilly, make us aware immediately.”

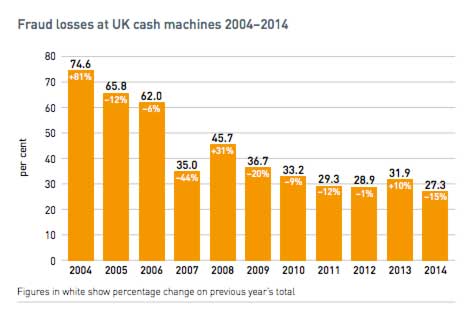

Thankfully it’s not all bad news

It seems these sorts of scams are dropping HOWEVER that doesn’t mean it doesn’t happen remember 2,500 Britons are victims of fraud at ATMs every week

![How to remove permanent marker from everything [Infographic]](https://10ways.com/wp-content/uploads/2016/02/marker-en-100x100.jpg)