We all know a mate that has avoided buying the right ticket for a train.

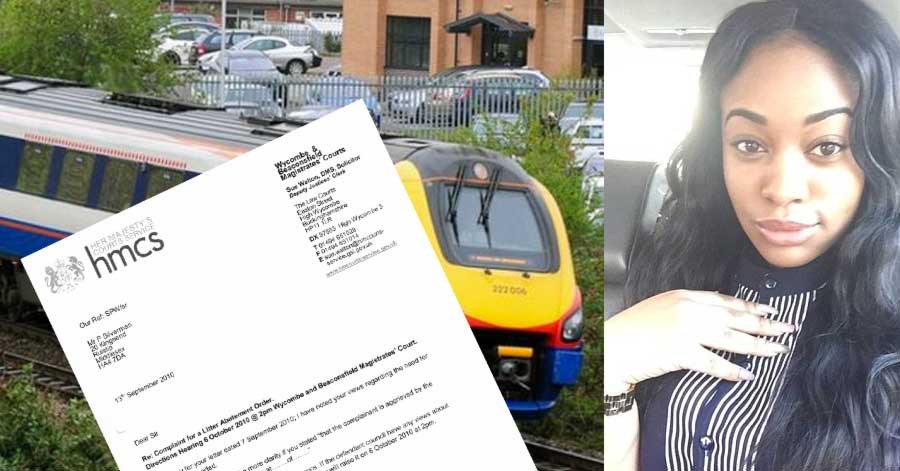

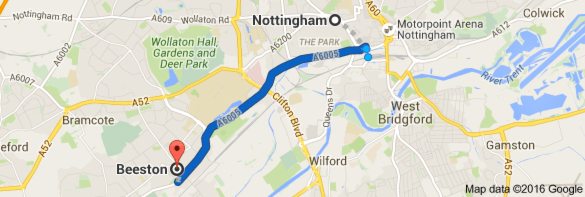

Parys Lanlehin, 20, who studies at The University of Nottingham was issued with a £20 penalty ticket on the Nottingham to Beeston train after she was travelling the wrong way on a return ticket.

She was fined £220 with £300 prosecution costs and a £22 government surcharge plus she was also ordered to pay the original £20 penalty.

Magistrates have given her 2 weeks to pay, otherwise, bailiffs most likely will be called.

Lanlehin, now lives in Walthamstow, London, she supposedly signed a declaration stating she was unaware of legal proceedings taking place in Nottingham at Stratford Magistrates Court, however, court proceeding had gone ahead against her.

The journey would have taken 5 minutes and is roughly 3 miles.

The maximum you can be fined for fare evasion is £1,000.

The Citizens Advice Bureau warns

‘If you travel by train without a valid ticket, you could be charged a penalty fare.’

‘A penalty fare is set at a higher rate than the normal fare and you must pay it on the spot,’

‘If you don’t pay it, you may be taken to court or risk your details being passed on to a debt collection agency.’

Great Western Railway said:

‘Fare evasion costs the rail industry about £240million a year.

‘To make sure that customers who pay for rail travel are not unfairly subsidising those who choose to avoid paying passengers are required to purchase a ticket prior to boarding a service from station ticket offices or from the available ticket vending machines.’