This is designed as a bit of fun, not to be taken seriously.

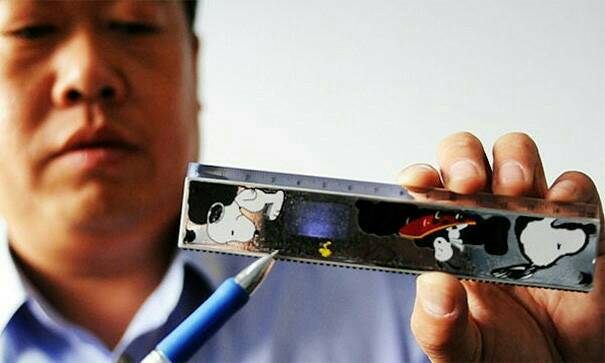

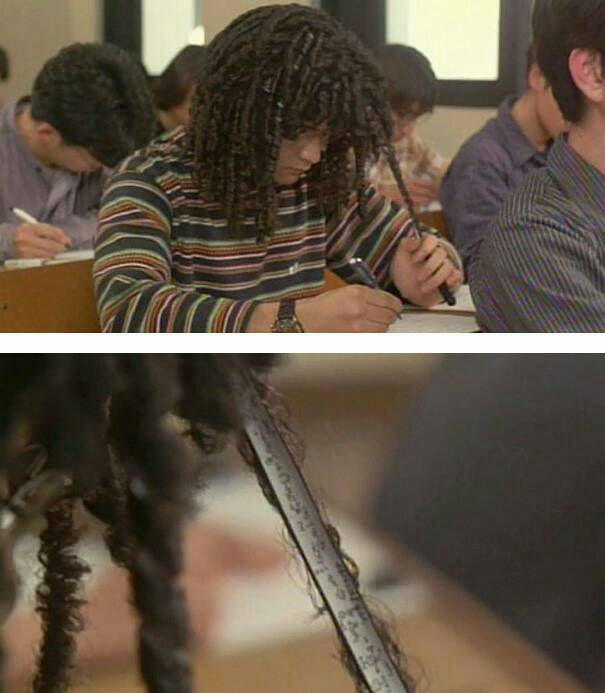

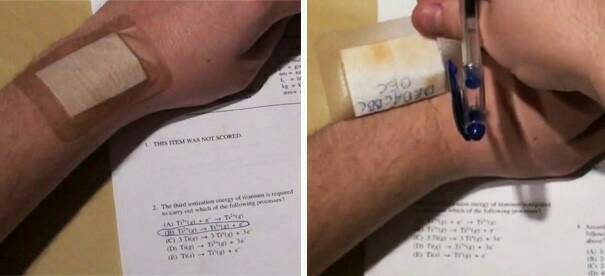

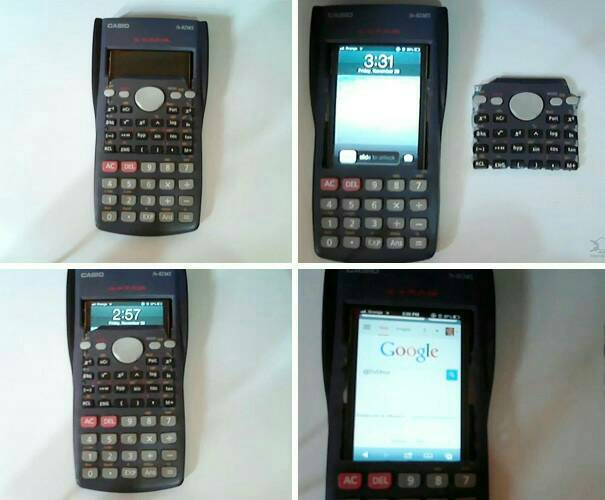

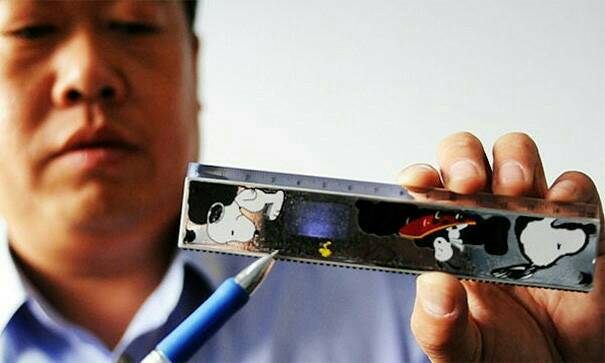

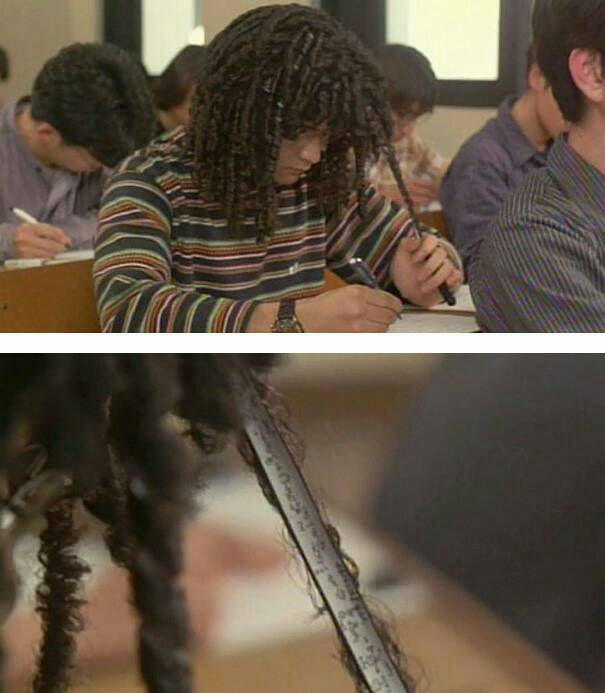

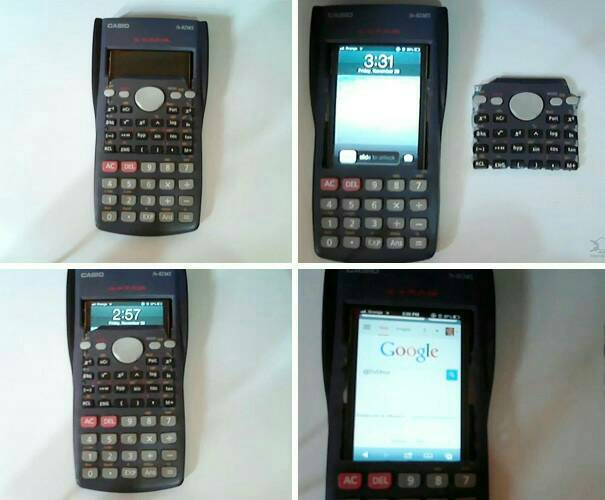

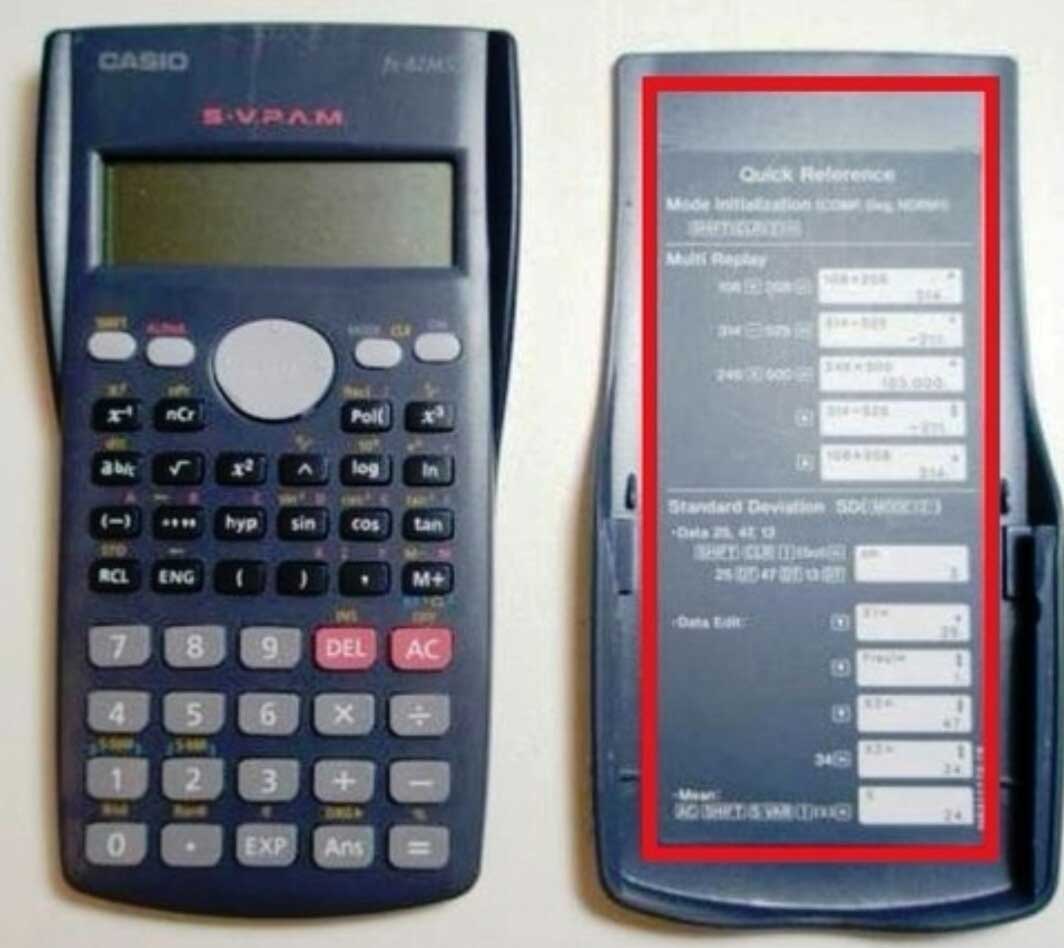

LED Screen inside ruler

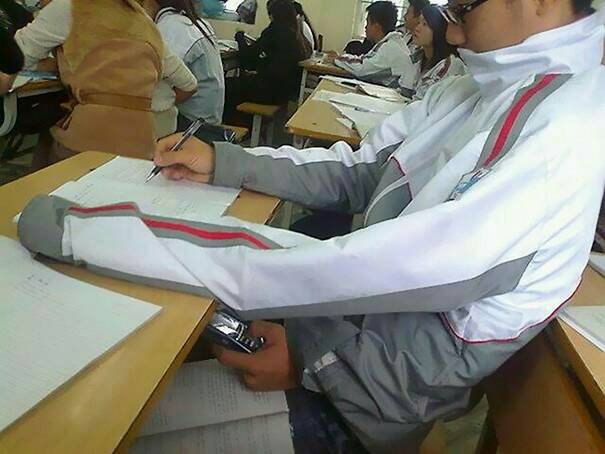

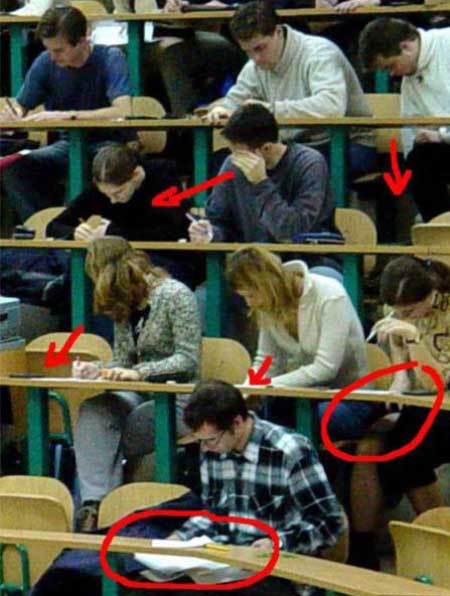

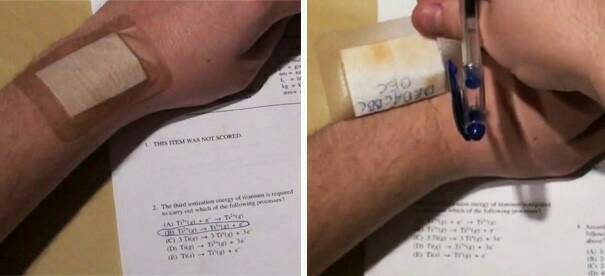

Pin Camera in glasses

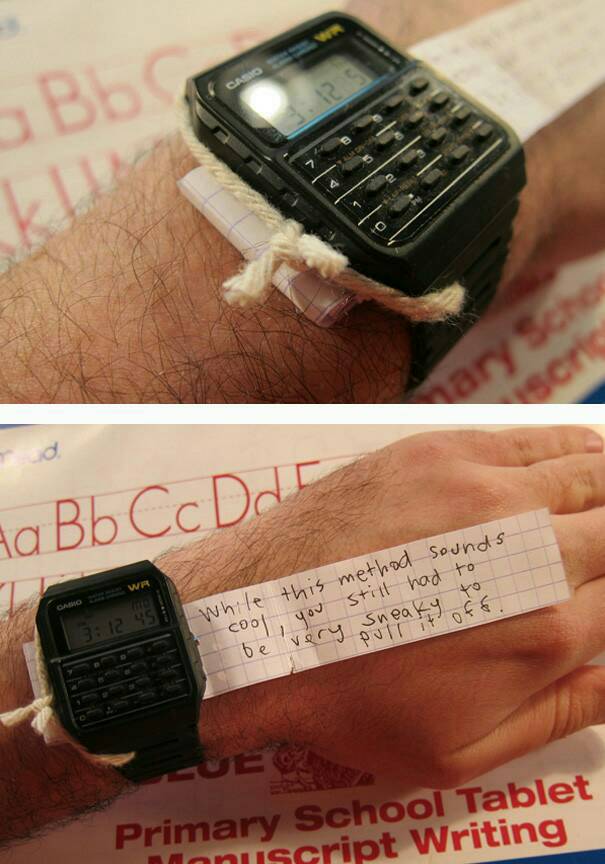

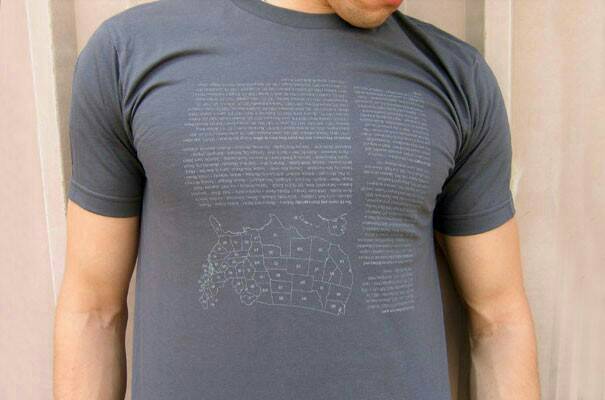

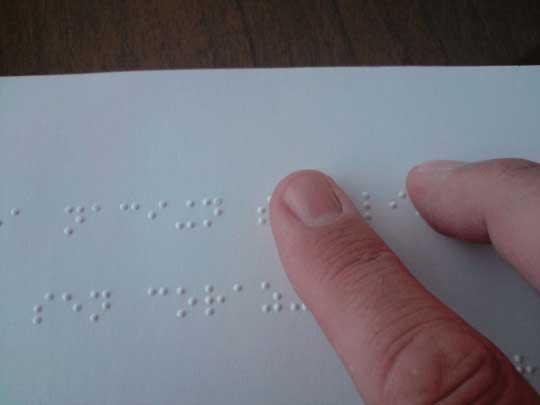

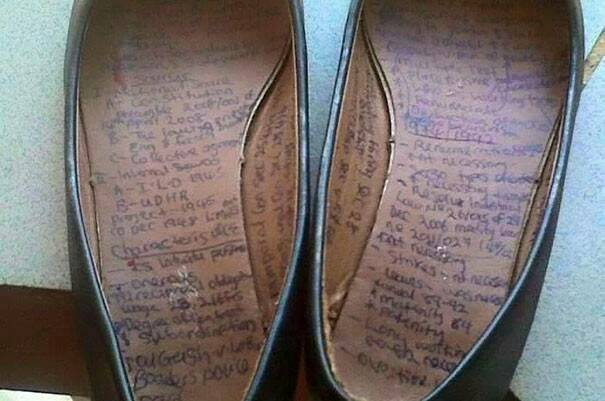

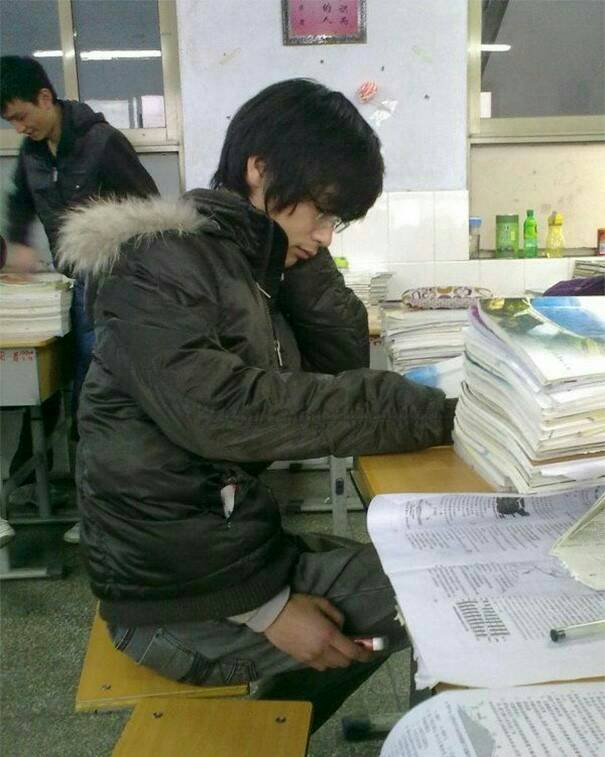

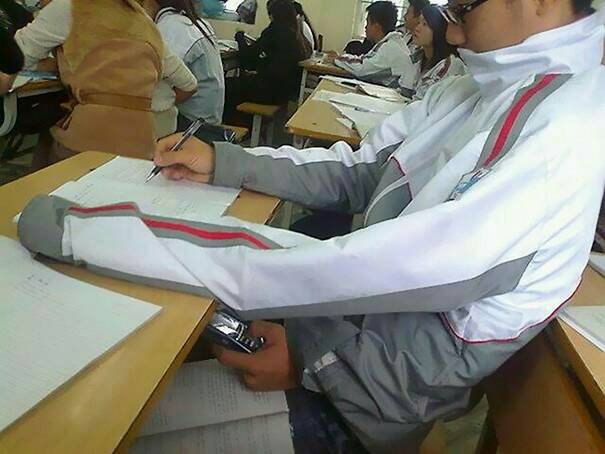

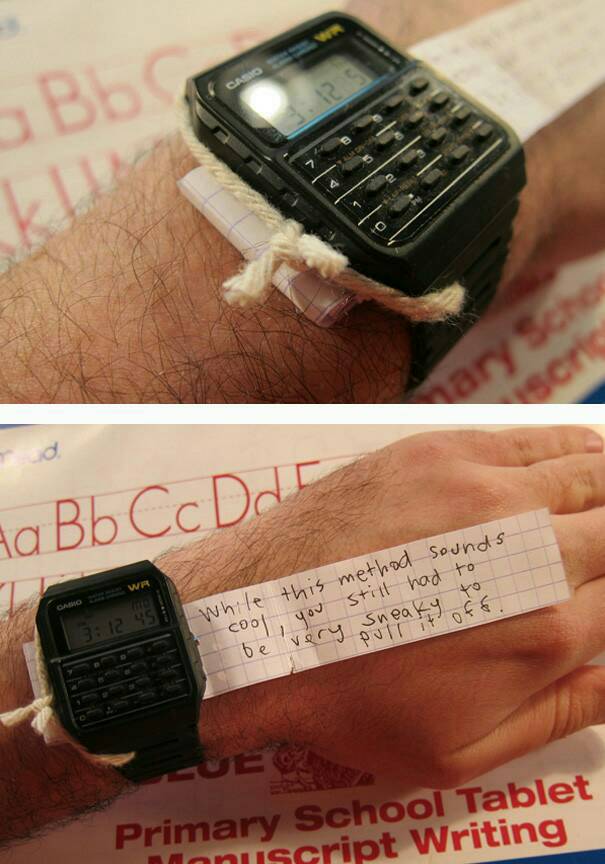

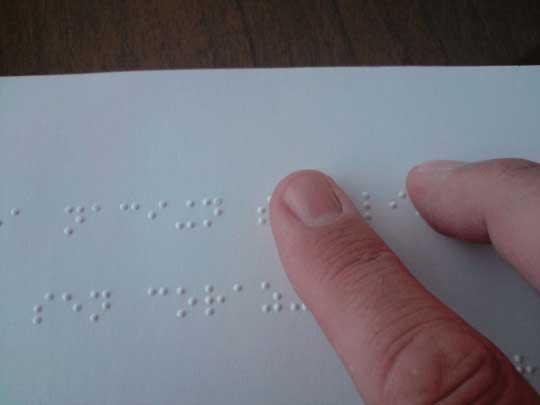

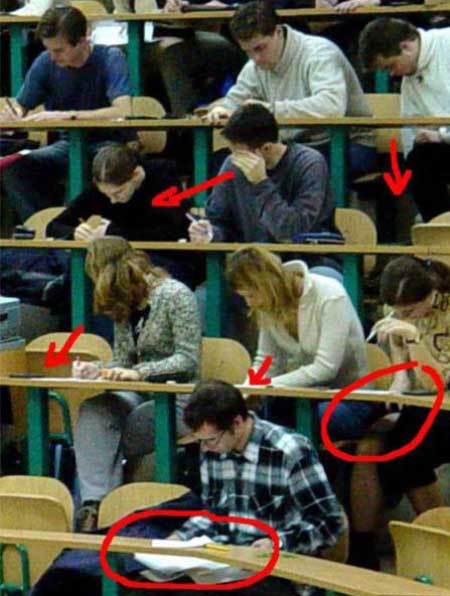

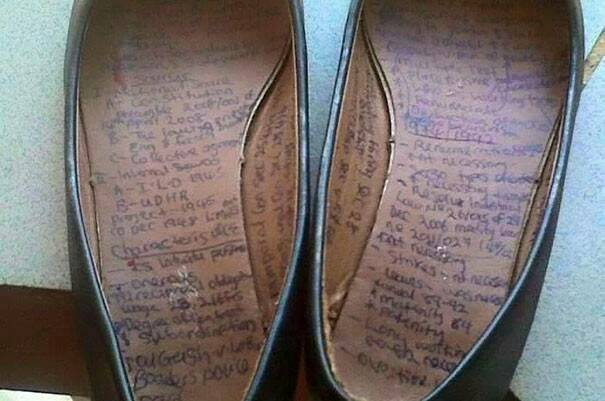

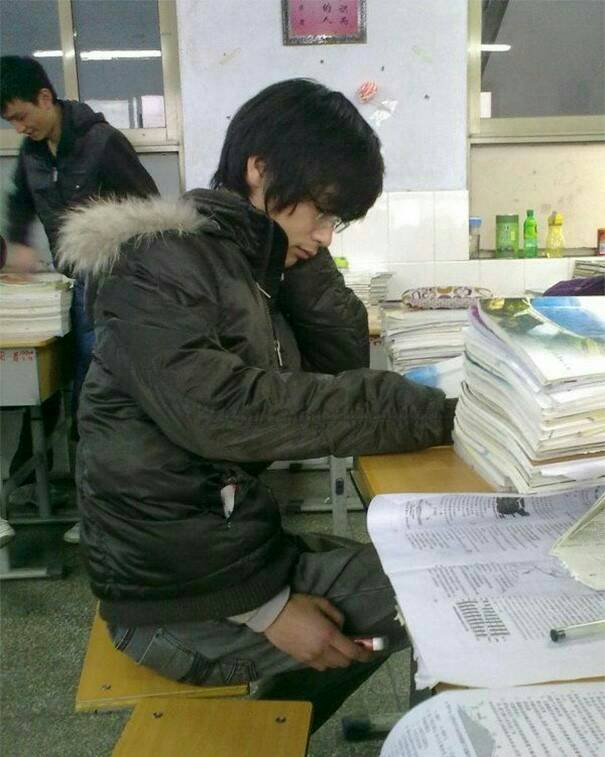

Life decisions: 1) Learn a course or 2) Learn Braille

This is designed as a bit of fun, not to be taken seriously.

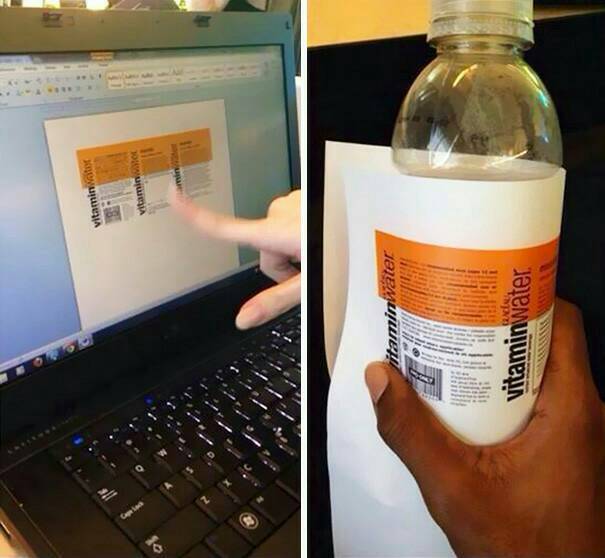

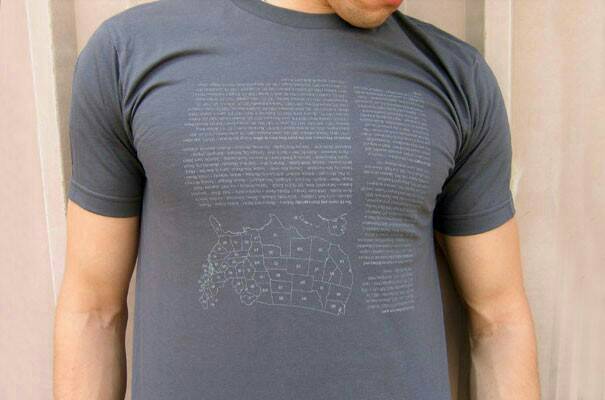

LED Screen inside ruler

Pin Camera in glasses

Life decisions: 1) Learn a course or 2) Learn Braille

![Guy can’t see the Eiffel Tower from his Bed, so he builds this awesome Periscope to see it [DIY ideas]](https://10ways.com/wp-content/uploads/2015/12/eiffel-100x100.jpg)