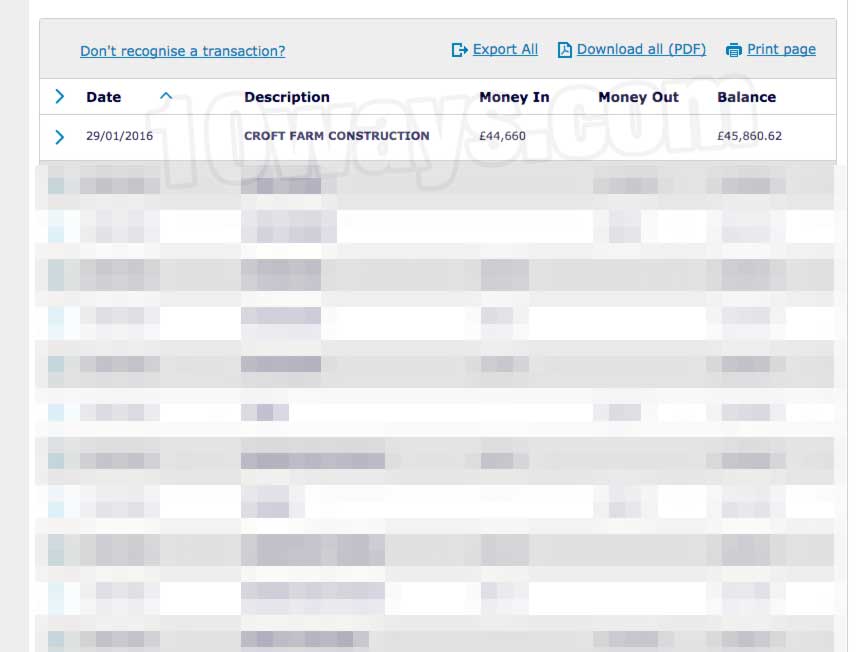

Steven Burke, a builder from Scarborough, had planned to do 3 weeks worth of work for a York-based construction firm (Croft Farm Construction) and had been expecting a payment of £446.60 for the first part of the work.

Unfortunately, the construction companies director Phil Gledall went to transfer Mr Burke his money but accidentally placed the decimal place in the wrong place!

Meaning 100 times Mr Burke’s invoice was paid to him instantly, a total of £44,660 instead of £446.60.

Mr Burke did what we all would love to do and spent the majority of the money almost instantly on the following:

- £12,600 was spent on gambling (that night)

- An electronic-cigarette

- Various hotel rooms

- Designer clothes

- An Audi car

- A gold chain

- Cocaine

- and finally some Vodka!

The prosecutor, Shyam Soni, told the court:

‘On January 12, 2016 the defendant did some labouring work for Croft Farm Construction.

‘This was a three weeks project and in the second week Mr Burke presented a cash invoice for £446.60.

‘This was paid by one of the bosses Phil Gledall at Croft Farm Construction.

‘Mr Gledall put the decimal point in the wrong place and paid £44,660.

‘On noticing the mistake straight away Mr Gledall tried to contact the defendant but he did not respond or answer any of his calls or emails.’

‘He also bought Audi A4 car for £2,000 – but it broke down the same day he bought it.

‘It was taken into the garage to be fixed – but the defendant could not afford to pay the bill because he had no money when the car was ready to be picked up.’

Barclays Bank PLC attempted to retrieve the money on March 10 but only could get £15,930.44 – because Burke had spent the rest.

The judge said:

‘This was blatant dishonesty – it wasn’t fraudulent but it was very opportunistic.

‘When Mr Goodhall tried to contact you of course he could not find you.

‘And when the bank tried to get the money back from you – they could only retrieve £15,000 because you had spent a large amount of it hadn’t you.’

Mr Burke ended up turning himself into Police on May 5 after cops tried to find him at a previous address he had given to his agency employer.

Mr Burke outside court

Burke was given:

- 100 hours of unpaid work within a year.

- A four-month sentence, suspended for a year (a suspended sentence basically means someone must comply with up to 12 court requirements e.g. the 100 hours of unpaid work, failure to comply means they would end up in prison for that sentence period e.g. 4 months)

- No mention of him having to pay the money back… if this is true he will effectively be earning £287.30* for each hour of ‘unpaid’ work *£44,660 money given to him – £15,930.44 money retrieved by Barclays / 100 hours = £287.30

What if he just put the £44,660 in a savings account?

From our calculations, he would have generated about £75 per month (after tax)* times this by roughly 6 months** = £450 profit

*Based on £20K with Santander 123 @ 3%, £2000 with TSB @ 5%, £5,000 with Club Lloyds @ 4% and £17,660 with Virgin @ 1.2%. **Interest paid monthly, he kept the money from January 12th 2016 and the court date was 25th July 2016 (195 days or 53.28% of 2016 or roughly 6 months). All data based on the fact he would have moved the money out from the original Barclays account, otherwise it would have all been taken back on March 10th.

Mr Burke declined to comment as he left York Crown court (whilst smiling and laughing).