18-month old Oscar Webb had his right eye sliced in half because of a ‘toy’ helicopter/drone that was flown near him and when it crashed into a tree it hit him in the face cutting his eye.

Mr Evans [who was the one ‘controlling’ the drone] said: “It was up for about 60 seconds. As I brought it back down to land it just clipped the tree and span round.

“The next thing I know I’ve just heard my friend shriek and say ‘Oh God no’ and I turned around and just saw blood and his baby on the floor crying.”

Oscar will have to undergo several other operations before he can have his new prosthetic eye fitted, pretty shitty for the poor kid all because someone didn’t think before playing with a big boy toy.

Mr Evans, who has been forgiven by Oscar’s family who regard what happened as an “awful accident”, said he had not used a drone since it happened: “I look at the drones in the garage and I feel physically sick.”

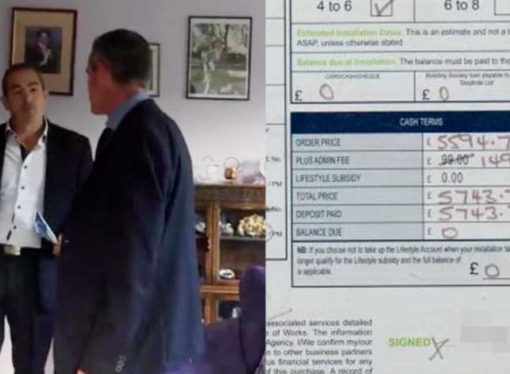

An example of the sort of drone that would have destroyed the kids eye

The problem is these quadcopters / drones are being sold alongside toys when actually they’re far from toys.

Oscar’s mother, Amy Roberts, said she was in the ambulance taking Oscar to the hospital in Birmingham when he opened his eye.

“What I saw, I can still see it now, and what I saw or what I thought I saw was the bottom half of his eye and it’s the worst thing I’ve ever seen.

“I just hoped and prayed all the way there that what I saw wasn’t true and wasn’t real.”

You’re not allowed to fly any drone/quadcopter/remote control plane within 50m of a person, vehicle, building or structure, or overhead groups of people at any height. People have been prosecuted for breaking these LAWS, it’s vitally important to keep drones away from kids as well as often they will think they’re toys.

![How social media will destroy your business [with proof] if you’re a d*ck &/or hurt animals](https://10ways.com/wp-content/uploads/2016/02/social-media-ruin-100x100.jpg)