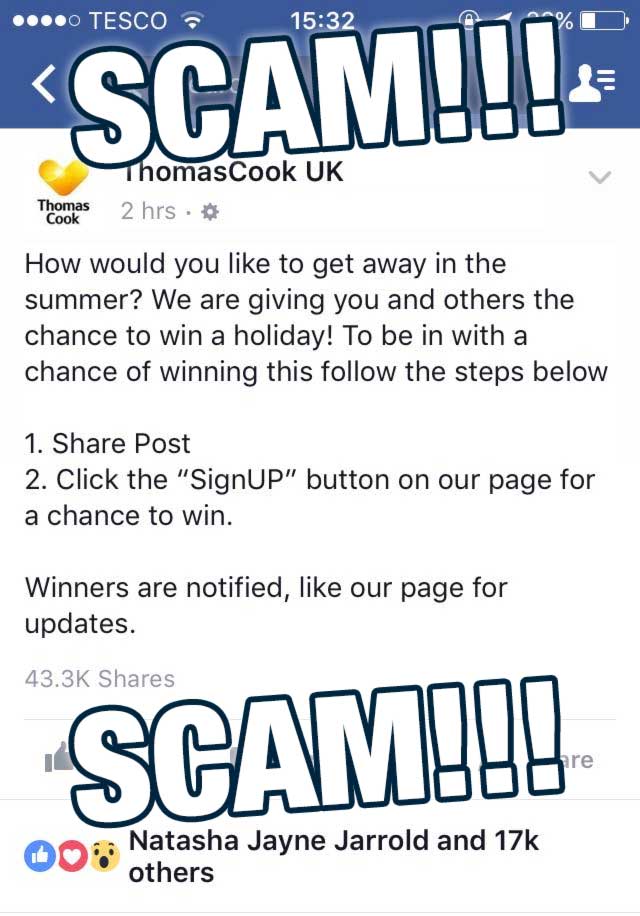

Another day, another obvious scam that thousands of people have fallen for.

This is exactly the same as:

But, this time, it’s from a Fake Thomas Cook page.

How do we know it’s a scam?

Isn’t it obvious? The points that make it an obvious scam:

- The page has hardly any likes

- The page name is clearly formatted wrong

- The page doesn’t have a verified ‘tick’

- The page asks you to share the post (against FB terms)

- Thousands of people have entered it, normally FB charge pages thousands to get that much reach from a post. By sharing the post it cheats the system.

- The fact Thomas Cook have publically said they know about it

Why do the scammers do it?

Simples, they get a large following, change the name of the group to something like ‘Student Events 2016’ and then spam the hell out of everyone with event invites to their actual events or sell the ownership of the group to someone else (often a spammer/scammer etc) for £50-£500.

Also, these groups are often related to student fresher groups, so the pages often change names to then promote club events or student tours etc.

If the scammers can’t use the pages to make profit they will run competitions (collecting your information, email address, phone number etc) and often sell your details on to whoever will buy it (although they deny this).

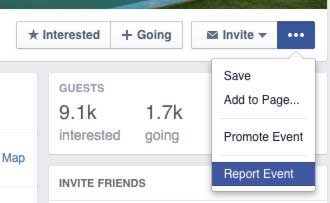

Report it!

If you EVER see a scam please take the time to report it, you help to keep social media clean of crap + may prevent others from getting scammed or spammed. The report function on Facebook is ideal for any of these events if you can still see them.

If you believe a company is selling your information on or using your contact information for something you’ve not agreed to be contacted about then it’s extremely important to report them to the ICO.

You may also like: