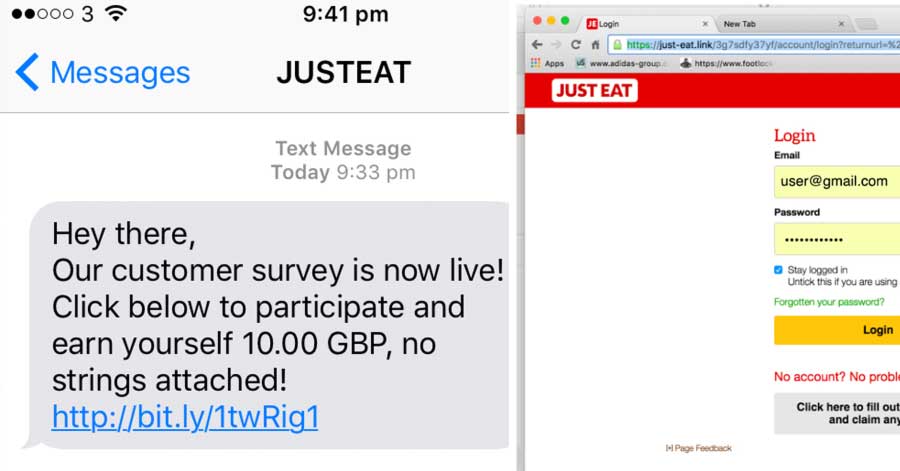

JUST EAT are aware of scammers pretending to be them in a series of text messages offering £10 for a survey competition.

A small number of UK customers have been sent fraudulent text messages claiming to come from JUST EAT. These messages offer recipients a cash incentive (£10 or £20, for example) to complete a survey hosted on a fake JUST EAT login page and asking customers to provide their JUST EAT account and bank account details.

These text messages are not from JUST EAT. We would never send an email or text message to customers asking for personal and financial details. We urge recipients of these messages not to enter their account or personal details on the login page provided and to take a screenshot, then delete the message immediately.

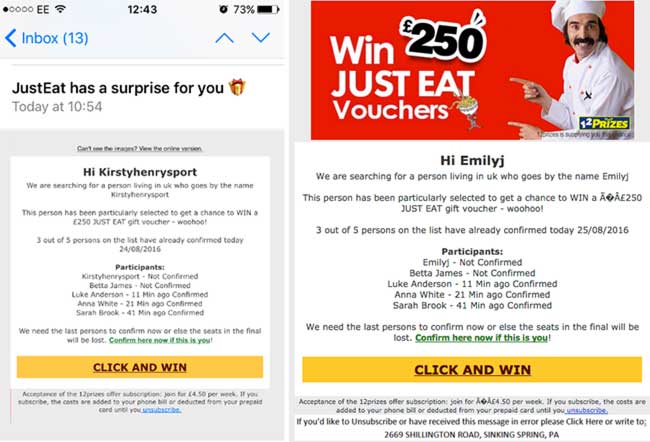

Along with scam texts customers and non-customers are still being sent dodgy emails from other sites pretending to be JUST EAT or related to them

If you have any questions – or if you are a JUST EAT customer and have received this text message – please contact us at [email protected] attaching a screenshot of your text. If you are concerned that you may have responded to this text message and your personal details have been compromised, please contact your bank immediately.

Unfortunately, text message and email scams remain all too common in this day and age. We urge all our customers to remain vigilant of their security across all their devices, frequently change their passwords and make sure their passwords are robust.

Full report from JUST EAT here