Things to watch out for:

- Remember it’s pretty much public records your previous address information

- Keep an eye on sites like HaveIBeenPwned to see if you data has been compromised

- If it’s HMRC they will send you a letter

When asked in an interview with the FT, HMRC said:

Scammers use a range of techniques, including phoning taxpayers and offering a bogus tax refund, or threatening them with arrest if they don’t immediately pay tax owed’

Do people really call for this sort of thing?

Sadly yes, and the trickster know it, so they continue via any means possible! It’s estimated £56m was lost to impersonation scams in the first 6 months of 2019, where criminals pose as police, bank staff or other officials!

What to do if you’re unsure:

- Always Google search the number, 90% of the time the number has been reported by others, if not report it yourself on sites like WhoCalledMe

- NEVER take action from a phone call like this

- NEVER click a link or attachment from within an email unless you’re 100% sure the sender is safe

- If anyone over the phone is asking for your bank details it’s likely a scam

- HMRC will never text or email you to arrange a tax rebate etc

- NEVER believe the threats of anyone on a phone call – Hanging up won’t allow someone authority to arrest you

- If you want to check something go directly to the HMRC / GOV website or call them (using the number listed on a piece a letter that you know is 100% from them or similar to check

- NEVER hand over information to anyone over the phone

- Remember even the experts get scammed!

- Report to [email protected] and ActionFraud

- Use alias emails for online forms

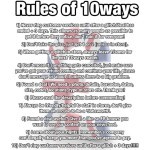

- Learn more: 10 ways to spot a fake/phishing email/message and how to avoid them in the future