Take a photo of all your expensive possessions, their serial numbers & receipts

Store the photos on Dropbox, Evernote or OneNote (i.e. the cloud/internet) &/or a USB stick or your computer.

If you ever lose something or it’s stolen, knowing the serial & having proof of ownership will greatly help you, the Police & your insurance claim!

OK, so it takes a few minutes every month to do it but it will save you so much time and effort if the worst ever happens!

Also, for mobile phones / tablets etc ensure you right down the IMEI number (International Mobile Station Equipment Identity AKA unique number to your mobile device) as well (dial *#06# and it will display the number!)

Who is likely to look out for your products if they know the full details:

- Pawn Shops or similar

- The Police

- Manufacturers (e.g. Apple)

- The community

- Immobilise Website (free) & Report My Loss (paid)

What is the best way to catalog your items?

- Find a service that is sync’d across the internet. We use Evernote but OneNote would also work.

- Create a Notebook called ‘Serial Numbers’ or similar

- Take multiple pictures of each item + serial number + receipt

- Store each item with easily searchable terms as the title e.g. Apple iPhone 5 64GB – #1232535serialnumber

- Ensure you make a backup of this data every few months/changes. If someone stole your laptop and it had access to Evernote they may delete it / wipe it and you would lose it all.

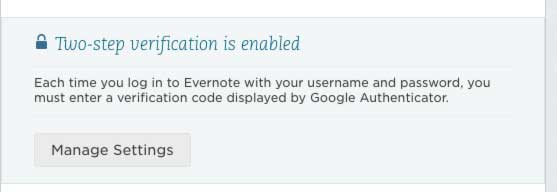

- Remember to turn on two-factor authentication for Evernote

- Now you’ve done all of that ensure you register the items on the Immobilise Website

Please turn on Two-Factor Authentication for your important logins (e.g. email, dropbox, notes etc)