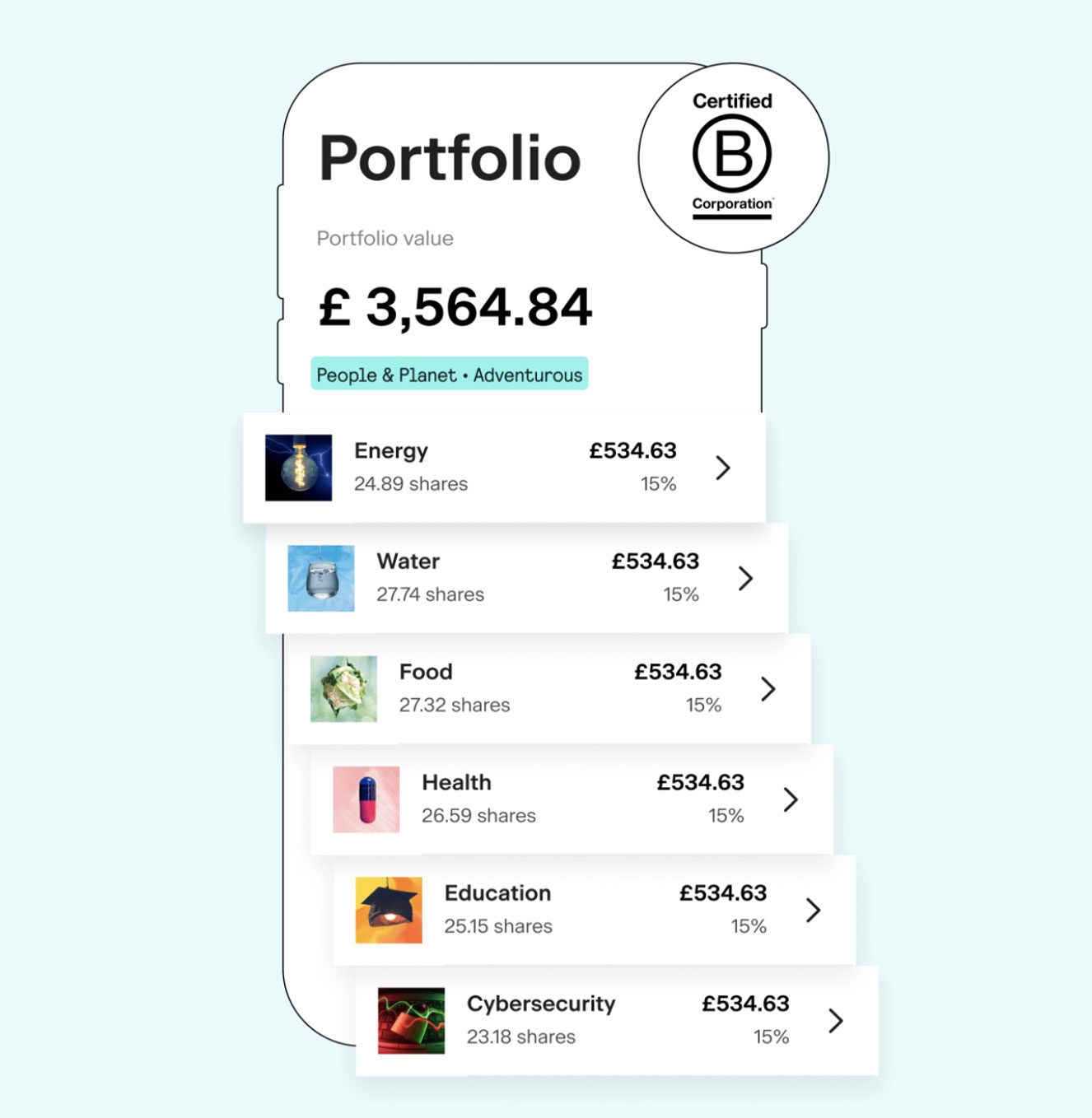

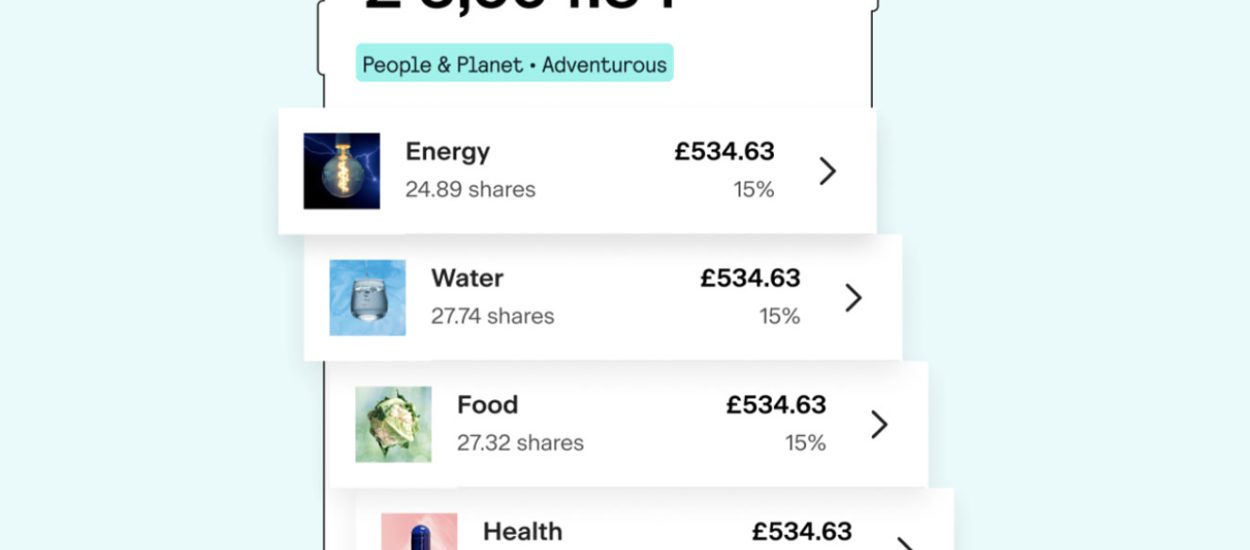

CIRCA5000 (previously known as Tickr) allows you to invest in the businesses working to build a brighter, more vibrant future whilst also (hopefully) giving you a decent return on your investment. CIRCA5000 invests in things for you that help us (humans) flourish: energy, water, food, health, education, and cybersecurity.

“The investment app that lets people make money – and a positive impact on the planet” – Forbes 1

The steps:

- Register and sign up (you get £15 for free via this link when you enter your email before registering)

- Choose your portfolio. Each CIRCA5000 portfolio contains different Exchange Traded Funds – the collections of companies your money is held in.

- Set a risk level – depending on your risk level, your fund will also include a proportion of Government Bonds, Green Bonds and cash

- Select your account type and top-up. Once you’ve made a deposit, they will invest your money in the chosen portfolio

- Setup if you will do monthly deposits or just do it manually when you have spare money to invest

- Consider automatic rounding up from your bank account, e.g. buy a coffee for £1.75, CIRCA5000 will take 15p and add it to your investment portfolio automatically (if you switch on this feature).

What are the fees/costs associated with using CIRCA5000?

Subscription Fee of £1 per month per account

Platform Fee of 0.5% p.a. of the balance of your account. This is collected monthly, based on 1/12th of 0.5% (around 0.06%) of your balance.

Any buying fees? Any closing of account fees? Any payment/transfer fees? No

- Any EFT manager fees? Yes, these vary depending on the funds you choose (see step 2 above) but are between 0.24-0.65% p.a. These external fees are paid to the fund managers (the people who look after which stocks and shares the EFT you’ve purchased hold). You can confirm the fees in the KIIDs (Key Investor Information Document) in your app before purchasing them.

So if you invested £500 in one year it would cost you:

- 12 x £1 = £12 (subscription fee, that goes to CIRCA5000)

- 0.05% of the £500 = £2.50 (platform fee that goes to CIRCA5000)

- between 0.24-0.65% (so let’s take the middle @ 0.44% for this example) 0.44% of the £500 = £2.20 (this goes to the people/companies who manage your money within the fund, i.e. the people that will buy and sell the shares on behalf of CIRCA5000 when they believe the times are right to buy and sell)

- = £16.70 in total fees for the year

Important note: This assumes your £500 doesn’t increase in value, if it increases (which you would hope it would as that’s sort of the whole point of this) then the fees would be higher in proportion to the increase in your investments.

Are the fees good at CIRCA5000 good?

This will dramatically vary on the level of investing you’re making, if you’re only investing £5 a month the fees will be very high as you would need to have a return on your investment of 20% yearly just to pay the fees, so you would be likely better investing elsewhere but continuing with the above example of £500 invested, each year your investment of £500 would need to grow by at least 3.34% just to cover the fees which means £500 would turn into ~£508.30 (after fees and assuming the account gave a 5% assumed net growth rate).

BUT if you were to invest £1000 (again assuming a 5% net growth rate) it would look something like ~£1028.60 (after all fees) and £2000 would look like £2,069.20 after 1 year.

Obviously, the important factor to remember (with all investing) is that if your investment doesn’t pay well or you even lose money then you still have to pay your annual/monthly fees. So with £500 invested, if you made 0% net growth you would end the year with £483.30 invested. If you lost 5% of your investment value you would be left with £458.30.

On the flip side if your £500 investment met the average stock market return rate over the last 10 years of 13.9% you would be looking at £552.80 (after fees).

tl;dr / So in short: The question ‘are the fees good?’ is likely answered by: Yes they’re good as long as you invest at least £100 per month or £1200 per year in this, if you’re investing less than that you should likely consider elsewhere.

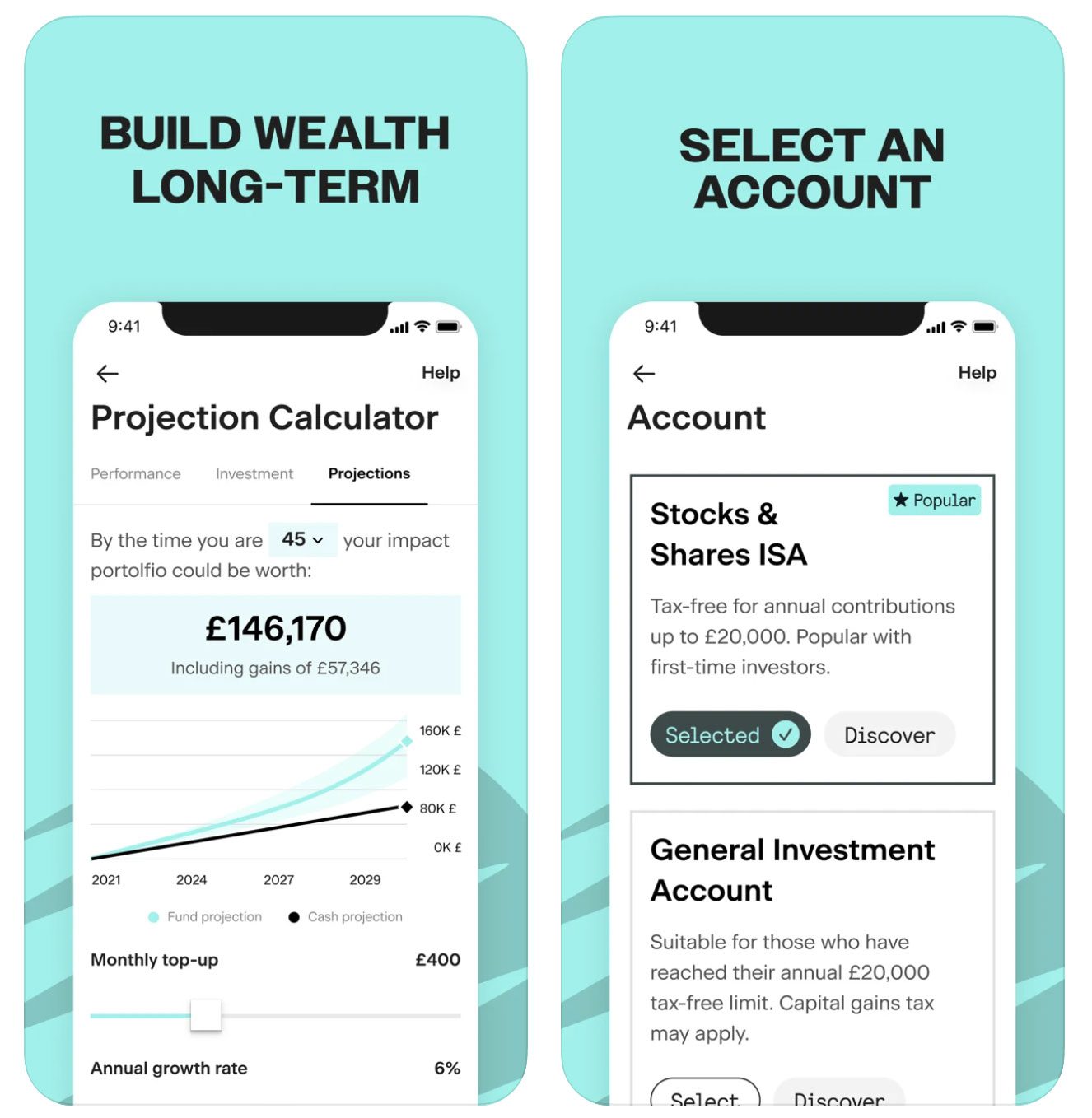

Your investment can be held within a:

- Stocks & Shares ISA (these are tax-free on any profits you make up to your yearly allowance)

- General Investment Account (you pay Capital Gains Tax on any profits when you sell or dispose)

- Junior Stocks & Shares ISA (these are tax-free on any profits up to their yearly allowance)

How quickly can I get my money?

It takes approximately 12 days from the moment you request your money to it arriving into your bank account.

Is my money safe?

Like all investing your investment can go both up and down, this app is the same, however, CIRCA5000 uses bank-level encryption. Investments are protected against firm failure (e.g. CIRCA5000 going bust) by the Financial Services Compensation Scheme up to £85,000 and CIRCA5000 is authorised and regulated by the Financial Conduct Authority: 846067.

What is an EFT?

An EFT is basically a FUND that comprises a selection of companies/assets, these can be bought and sold on the stock market just like an individual fund, the majority from CIRCA5000 are by recognised providers including BlackRock, Legal & General and Rize.

Do we use CIRCA5000?

Yes, we’re a paying customer. You can get £15 bonus by signing up with our link here

![Master Sushi Chef + McDonalds = awesome looking fast food! [Video]](https://10ways.com/wp-content/uploads/2015/11/gourmet-food-mcdonalds1-100x100.jpg)

![[EU Roaming customers only] EE mistake costs the company £2.7M and they’re refunding £250K to customers](https://10ways.com/wp-content/uploads/2017/01/ee-100x100.jpg)