What is Freetrade?

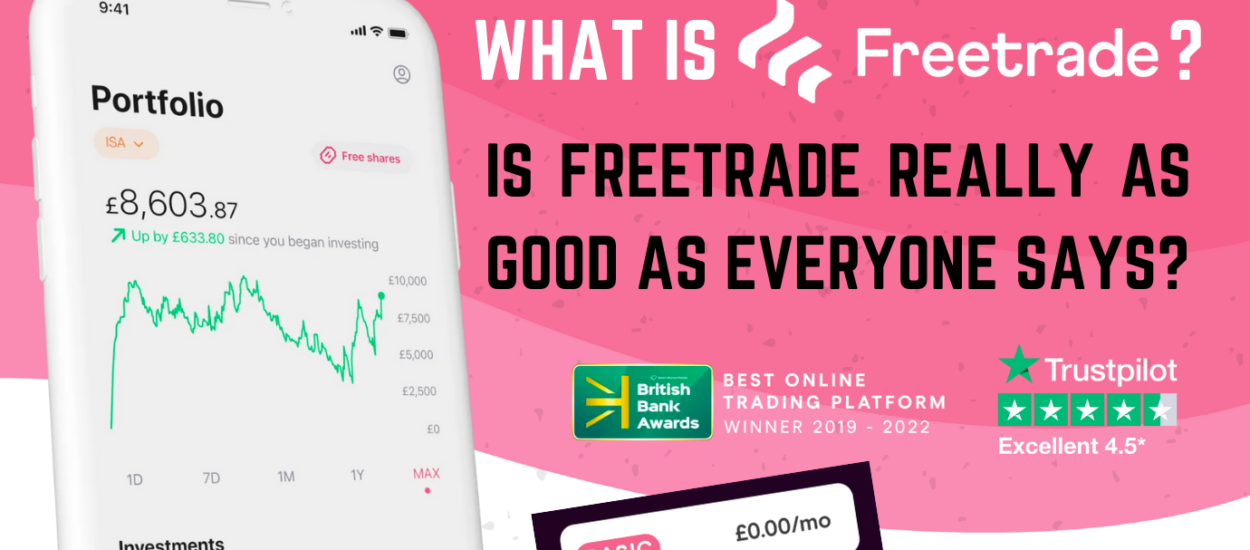

Freetrade is a low-cost investing app that has been massively growing in popularity in recent years thanks to its ease of use, extensive online learning resources, and low fees (note we say low fees and not ‘no fees’ here, more on the fees later).

But how does it work? And is it really free to use?

The Freetrade app (available for iOS and Android) is intuitive and easy to use, with a simple dashboard that lets you quickly fund your account, view your current investments, place trades and withdraw money back to your bank account.

There are also detailed tutorials and guides on the Freetrade website that will help you learn how to make the most of this popular investing platform and hopefully increase your net worth (although it’s very important to remember investing in stocks and shares is not guaranteed to give you a profit. In fact you could see less money).

One of the main benefits of Freetrade is its low fees. Unlike many other investing apps and platforms that typically charge a fee per trade (often up to £12 per trade) AND a subscription per month (often 0.25% or £10 per month) Freetrade typically charges no fee per trade and their general investment account (GIA) account charges £0 per month. The only time they charge fees are when:

- You’re paying for one of their additional account benefits (e.g. £4.99 per month for their tax-efficient stocks and shares ISA (well worth the £5 per month) or £9.99 for Plus which includes a Self-invested personal pension (SIPP).

- You’re buying foreign company shares (e.g. buying Apple shares in USD and your account is funded in GBP), this is charged at the spot rate (this means whatever it’s worth) + 0.45% fee (i.e. on a $100 transaction you would be paying Freetrade $0.45 or the equivalent in GBP). Customers can see this breakdown before an order has been executed. If you’re doing lots of trades in USD etc then these fees can rack up quite quickly but for occasional buying the fees are fair (they have to make money somehow remember).

Is it right for me?

Ultimately, that depends on your individual needs and goals. While Freetrade may not be right for everyone, it is certainly one of the most popular investing platforms out there today, and can be a great way to start building your portfolio. So if you are looking for an easy-to-use, low-cost investing app, Freetrade is definitely worth considering/trying out.

And if you need/want additional learning their website is great for helping with the basics all the way to more advanced info on how to trade shares and which companies to consider or at least which companies other people are buying.

Should I consider the Freetrade Standard plan @ £4.99 per month (equivalent to £59.98 per year)?

Probably is likely the answer here but this will depend on your personal circumstances, current salary, and appetite for a wider range of stocks.

The main benefits of the Standard plan are the fact you can wrap up your investments inside an ISA. This simply means any profits you make don’t attract capital gains tax or UK dividend tax (unlike the Basic account @ £0.00 per month, if you were to go over your yearly capital gains allowance). The second major benefit is you get access to 6,000+ different shares vs the fairly limited 1,500+ shares offered in Basic.

How do I withdraw funds?

You can withdraw funds to any UK bank account, this typically takes 2-3 days, although you should appreciate you will also need to sell any shares beforehand but the funds only become available to withdraw (known as settled) approximately 2-3 days after being sold, which is pretty standard across investment platforms. So to recap, if you had say £250 in shares @ 1pm on a Monday, 9 days later (could be sooner) on Wednesday you would definitely have the money in your account (i.e. a total of 5-8 working days from the moment you sell the shares to them being in your bank account).

Is there anything I should be wary of?

- The monthly fee for paid accounts has previously increased (by 66%), which obviously was frustrating for those customers who (understandably) preferred to pay lower monthly fees. We doubt a fee increase will happen again anytime soon and we fully appreciate these companies need to make a profit but it’s something to consider.

- If you’re buying a SIPP with any provider, make sure you understand what would happen with the pension in the event of your death, from our understanding it’s quite restrictive.

- The price of a share you see isn’t always the price you pay, because of the way the markets work, the live price you see in the app reflects the ‘last price’ of the stock. This is the most recent price that the security was bought or sold at that Freetrade received from their pricing provider. You can check when this price was actually executed by scrolling down to the grey timestamps at the bottom of the page when viewing a stock. When executing your order, Freetrade takes quotes from multiple sources to ensure that they get the best price possible for you. This means you may find the actual price you need to pay or receive, may be different to the price you saw in the app.

- Previously, free benefits have been removed and added to their paid account options, we understand why this happens but it has frustrated some existing customers.

- There is no phone line or chat support, all correspondence is via the app and messages/emails, this generally is ok (expect a response in 2-3 days, or quicker if you’re on one of their paid plans) but something to consider if you prefer picking up the phone.

Are there any new customer sign up benefits?

Yes, if you sign up to Freetrade using this special link, follow the steps to sign up, complete a digital W-8BEN form, which lets you buy US shares (takes 10 seconds) and fund your account with at least £50 you get a completely free share worth at least £10.

Disclosure

When you invest your capital is at risk, the value of your portfolio can go down as well as up and you may get back less than you invest.

ISA, SIPP and tax rules apply. Please remember tax relief depends on your personal circumstances and current rules can change. SIPP is a pension product designed for people who want to make their own investment decisions. You can normally only access the money from age 55 (57 from 2028). Before transferring a pension please ensure that you will not lose valuable guarantees or incur excessive transfer penalties. Free share terms apply. 18+, UK only.

We would still post about Freetrade regardless as we love it but we believed so much in the future of Freetrade and everything they’re doing that we actually invested in their company as shareholders. We also are rewarded if someone registers an account via our affiliate link.

![Master Sushi Chef + McDonalds = awesome looking fast food! [Video]](https://10ways.com/wp-content/uploads/2015/11/gourmet-food-mcdonalds1-100x100.jpg)

![How to get sent crates of Heineken 0.0 sent to your workplace [April 24th 2020]](https://10ways.com/wp-content/uploads/2020/03/heineken-100x100.jpg)