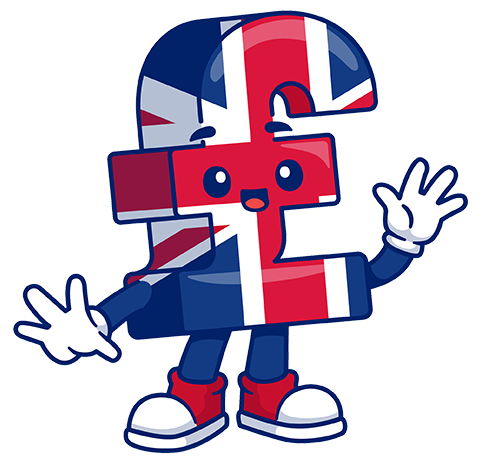

EE customers who called the EE 150 customer service number while roaming within the EU (between 2014-15) were incorrectly charged £1.20 per minute instead of the normal 19p per minute charge, 32,145+ customers were overcharged which added up to £245,700 in total.

Ofcom has fined EE £2,700,000 for the mistake, proceeds of the fine will be passed on to the Treasury.

While the majority of customers have now been refunded, EE was unable to identify at least 6,905 customers, who have been left around £60,000 out of pocket.

The company has made a donation of just under £62,000 to charity in lieu of the payments owed to these customers.

EE said in a statement:

‘We accept these findings and apologise unreservedly to those customers affected by these technical billing issues between 2014 & 2015.

‘We have put measures in place to prevent this from happening again, and have contacted the majority of customers to apologise and provide a full refund.

‘For those customers that we could not identify, we donated the remaining excess fees to charitable causes in line with Ofcom’s guidelines.’

Lindsey Fussell, Ofcom’s consumer group director, said:

‘EE didn’t take enough care to ensure that its customers were billed accurately. This ended up costing customers thousands of pounds, which is completely unacceptable.

‘We monitor how phone companies bill their customers, and will not tolerate careless mistakes. Any company that breaks Ofcom’s rules should expect similar consequences.’

![[EU Roaming customers only] EE mistake costs the company £2.7M and they’re refunding £250K to customers](https://10ways.com/wp-content/uploads/2017/01/ee.jpg)