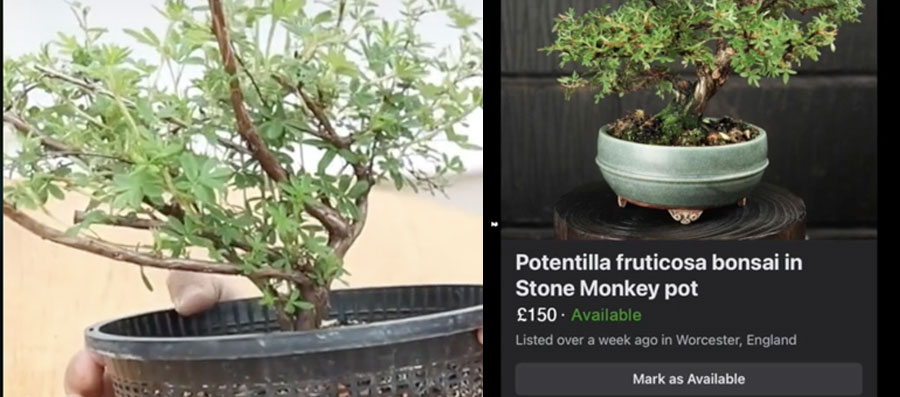

OK so it took 3 years for grobonsai to make £150 but still if you have the spare time this could be a fairly simple business (once you learn the basics of Bonsai). Prune, wait, wire some shape into the new branches, added a new pot (likely the biggest expense although you can find many under £10 here), trim the flowers off, snap some great photos and sell online.

See the video below.

How simple is growing bonsai trees?

This is a difficult question to answer, as it depends on the level of difficulty you are willing to tolerate. If you’re just looking to grow a few basic trees with little fuss, then it can be quite easy. However, if you’re aiming for perfection and want to create intricate designs, then bonsai can be quite challenging.

How can I save money when growing bonsai trees?

One way to save money is to start with inexpensive trees. Trees that can be easily trained into bonsai, such as junipers, are often quite affordable. You can also look for trees that are already in bonsai pots, which can sometimes be found at garage sales or online auctions. Another way to save money is to grow your own seed. This can be a bit of a gamble, as it’s often difficult to get seeds to germinate, but it can be very rewarding if you are successful. You can also take cuttings from other bonsai growers or friends with bonsai trees.

How much time does growing bonsai trees take?

This is again a difficult question to answer, as it depends on how much time and effort you are willing to put into it. If you’re just growing a few basic trees, then it won’t take very long. However, if you’re aiming for perfection, then it can take many years to create an intricate bonsai design.

@grobonsai Bonsai hustle #bonsai