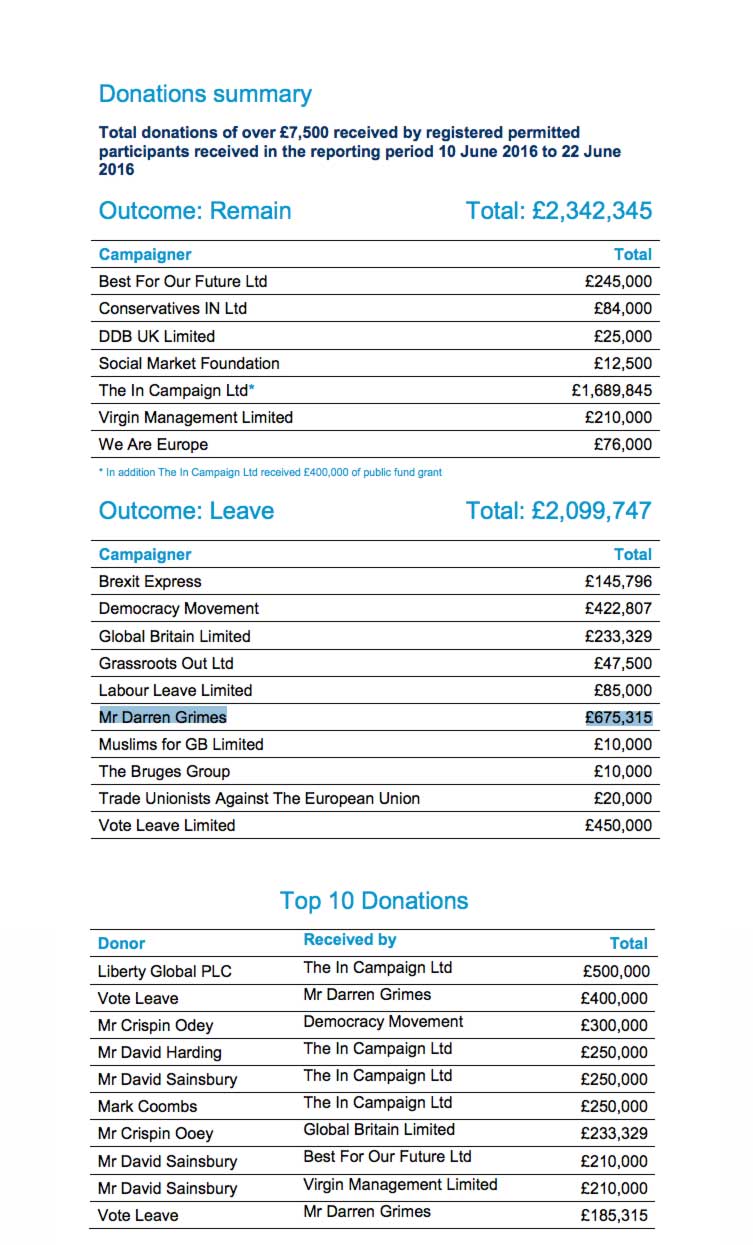

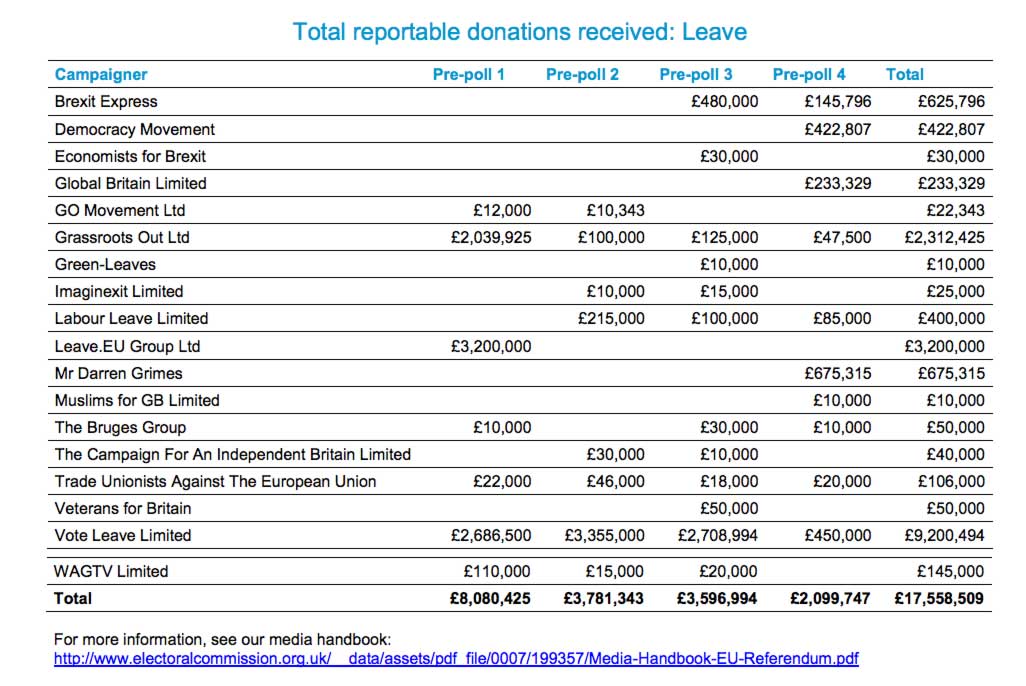

Darren Grimes, a design / fashion student (mixed reports of studying both) at The University of Brighton that is now an intern at a design agency in Kennington, London was reportedly given a total of £675,315 in donations for his BeLeave campaign.

If these numbers from the Electoral Commission are correct then the Vote Leave campaigner was one of the best-funded unofficial campaigners of the whole process (from either side). Supposedly, a Vote Leave source stated that the money was given to Mr Grimes to ensure the full £7,000,000 spending limit had been used.

Supposedly, a Vote Leave source stated that the money was given to Mr Grimes to ensure the full £7,000,000 spending limit had been used.

Darren set up BeLeave campaign which has 6323 likes on Facebook, with content mainly consisting of links to other sites, screenshots of newspapers, quote images, animated gifs and video interviews.

Also a Twitter and Website (now expired but viewable here) were setup. Mr Grimes has previously stated that a large amount of the money was spent on political consultancy from AggregateIQ, who are ‘data and social media experts.’ for reference they have a total Twitter following of 2….

“AggregateIQ helped us reach as many people as possible,”

“As a digital campaign targeted toward millennials, it was essential we reached our target audience. AggregateIQ used video advertising, Google Ads, landing pages on our website to inspire sign-ups and help us get out the vote on polling day using text messages and newsletters.” – Darren told BuzzFeed

Darren was featured on a BBC mini-documentary called #InMyShoes

Judging by the content produced obviously a decent amount of work / time went into the artwork and animation of gifs etc but we will leave it to you to decide if the £675,315 was well spent:

Darren was given all of this money towards the end of the campaign

A few examples of the work:

This work has obviously taken it's toll

We're only just half way through the year and already it has been the craziest 7 months of my life. I think I need a holiday/padded cell.

— Darren Grimes (@darrengrimes_) 29 July 2016

But I guess the money helped

Magnificent birthday in Cambridge. Champagne dinner this evening. If you're going to do it - do it right. pic.twitter.com/mFbb2fVE4K

— Darren Grimes (@darrengrimes_) 22 July 2016

Lets just hope there was some spare cash left over in case he damaged that Tesla's Aluminium bonnet by sitting on it!

Tesla #lad pic.twitter.com/AHImYCKAJf

— Darren Grimes (@darrengrimes_) 23 July 2016