Curve allows you to consolidate multiple bank cards into one, so if you have:

- A work/business card

- A credit card

- A debit card

- A non Apple Pay or Google Pay supported cards

- Foreign exchange or additional card (e.g. Monzo / Revolut)

- &/or a Non-GBP card

You can now add them all virtually to one physical card and switch between which card is charged via the app (before or after you purchase), this means you can effectively dump your wallet full of cards and just have one single payment card.

What are the other benefits?

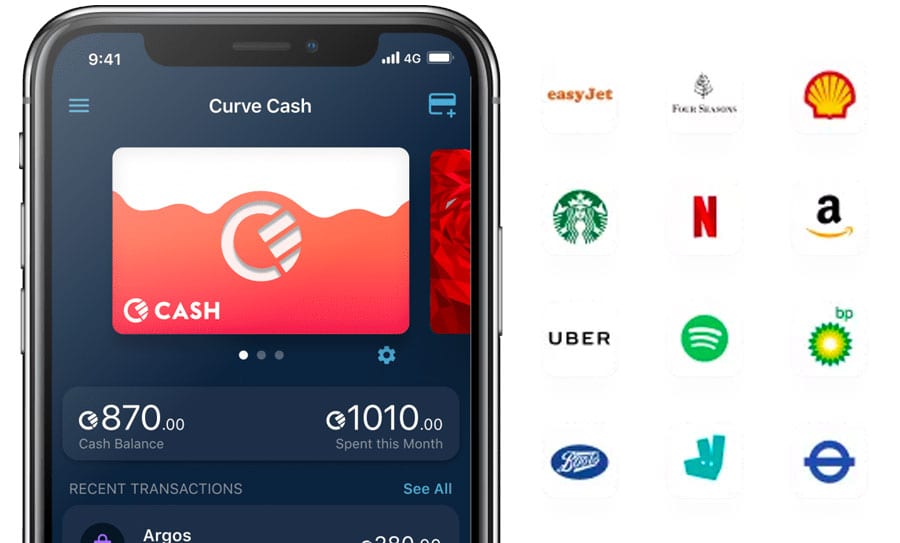

- Up to 1% cashback at up to 6 selected stores (e.g. Uber / Tesco / JustEat / Waitrose / Underground / Amazon)

- Instant freezing/blocking of your card if it’s lost and unfreezing when you find it again

- Go Back in Time up to 14 days (basically allows you to swap which bank card you used after paying)

- Curve £100,000 Customer Protection on your purchases

- Completely free account for the Blue card, £9.99 p/m for Black or £15 p/m for Metal

- Works just like a normal Mastercard Debit card worldwide

- Fee-free foreign ATM withdrawals up to £200 /month (blue), £400 (black) & £600 (metal)

- Combines all your spending into one app, so you can keep an eye on all your finances

- Travel reports telling you how much your whole holiday/business trip has cost you so far

- Business customer? Simple expensing and with no currency fees for you or your employer

- £10 free when you sign up using code TEN10 – download the app and enter code TEN10

So how does it work?

- Open a Curve account

- Scan/enter one or more of your credit/debit cards into the app – these are then “protected with financial services industry-standard encryption and security measures” and virtually stored within the app

- Use your Curve card to spend money anywhere that accepts Mastercard, using the app to choose (either before a transaction or after) which account/card to spend from

Is it secure?

Like the majority of new aged banking apps, they all use financial services industry-standard encryption and security measures to keep your details secure and private, they also have:

- Standard pin code for the card

- The ability to lock/freeze the card instantly from the app

- FaceID / Finger Print / Password login to the app

- Curve Customer Protection for up to £100,000 on all purchases

- 24-hour support line that users can contact to shut the card + app down and protect all their payment cards at once.

How does the cashback work?

How does the cashback work?

You select the companies you wish to get cashback with and then every time you spend there the cashback is automatically and instantly added to your ‘Curve Cash’ virtual card.

The best part of Curve Cashback is that you can combine it with the underlying payment card you normally use and their cashback benefits, for instance, our Amazon Credit card gives us points on all spends but now we can combine this with Curve Cashback to get double cashback!

The only issue is if your underlying card offer enhanced cashback/rewards at certain retailers, for instance, our Amazon Credit card gives us bonus points for spending money at Amazon, if we were to use Curve on the Amazon website we wouldn’t get these additional bonus points as all transaction appear to come from Curve and not the retailer you’re purchasing from.

| Curve Blue | Curve Black – £9.99 per month | Curve Metal – £15 per month |

| 1% instant Curve Cash for 90 days | 1% instant Curve Cash for an unlimited time | 1% instant Curve Cash for an unlimited time |

| Additional benefits like gadget insurance included (worth ~£5.99 a month) + Travel insurance. | Additional benefits like discounted Loungekey™ airport experience (saving ~£25 saving per visit), Rental Car Premium Insurance & superior travel insurance from AXA. | |

| 3 retailers | 3 retailers | 6 retailers |

The rewards are redeemable as a separate balance within the app and cannot be transferred to a bank account etc, which does mean to spend all the cashback you would need to make transactions inline with the amount of cashback you have, an easy way around this limitation is to buy Amazon gift cards or top up your Paypal account with exactly this amount.

So can I profit from the cashback?

It massively depends on you, your monthly expenditure, whether you will be putting through any business/work expenses and how smartly you shop but it’s possible but unlikely.

The Blue card is FREE so in the first 90 days the cashback will easily give you a profit, however, after this period you won’t be getting any cashback benefits unless you upgrade your account, so without cashback, you just have the time savings and the fact you’re not carrying around 3+ bank cards.

The Black card costs £9.99 per month and whilst you get additional benefits, you would have to spend a combined total of £999 each month at your three chosen retailers before you break even, however, it’s important to factor in the additional benefits and your savings with these before you stop considering the £9.99 per month, but even then unless you’re spending a decent amount each month on cashback applicable merchants you’re unlikely to profit from this.

If you buy the Curve Metal card and use the additional perks it’s possible for the card to pay for itself fairly quickly, especially if you’re a frequent flyer and if you pay upfront for the yearly card.

Get £10 free when you sign up using code TEN10 – download the app and use code TEN10

What are the drawbacks:

- Those with Credit Cards – If you purchase items from £100 – £30,000 on a credit card you’re automatically protected with Section 75 of the Consumer Rights Act which allows you to claim the total amount spent against the credit card company if something goes wrong. With Curve you waive these rights from your credit card company and instead, you use Curve’s £100,000 Customer Protection Promise. Whilst Curve’s protection on paper appears superior it’s not in UK law so you could have problems in the future, our suggestion would be for important/large/untrusted payments would be to use your main credit card. You do also get access to Mastercard’s chargeback scheme, explained on here which offers further protection.

- No support for American Express

- Takes 72 hours for your free £10 signup bonus to arrive

- The card doesn’t work well at petrol station fuel pumps (blame people scamming the petrol companies)

- [Work in progress] Currently no integration with Apple Pay, Google Pay and Samsung Pay

- If you’re looking to sign up to Curve just to take advantage of the fee-free use abroad you may wish to look elsewhere, Monzo or Revolut might be better.

I only have 1 or 2 bank cards is it worth it?

I only have 1 or 2 bank cards is it worth it?

Curve is best for people with 2+ cards that they use frequently, for instance, we have:

- 2 x credit cards (with different perks)

- 2 x debit cards (with different features)

- 2 x business cards (two businesses)

Now we just have 1 Curve card with us + Apple Pay.

I have Apply Pay or Google Pay, why would I use this?

Curve are working on integrating Apple Pay, Google Pay and Samsung Pay with their cards, however, currently it’s a fair point if you’re already using these services you may find you don’t need Curve, but something that Apple Pay cannot do is swap your payment from one card to another after you’ve paid. For us, several of our bank/credit cards (e.g. Barclays Business / Amazon Credit) aren’t on Apple Pay so this solves that issue + we now get the other benefits of Curve on top which is something Apple/Google Pay don’t provide.

What cards can I use with Apple Pay?

|

|

Are the premium cards worth it?

Metal Card – £15 per month or £150 if paid annually in advance

If you like to show off, fly more than the average person, don’t have existing gadget/medical/car rental insurance and spend more than the average person this card could be for you. These are all the benefits:

- 18g brushed metal premium card (you do get people constantly asking about it) in a choice of colours

- 1% cashback at up to 6 retailers

- Fee-free worldwide ATM withdrawal (up to £600 per month)

- £800 gadget insurance (worth ~£5.99)

- Worldwide Travel Insurance giving you £15,000,000 in medical cover with baggage and personal belongings cover

- £25,000 Rental Car Collision Damage Waiver Insurance provided by AXA Travel Insurance

- Get access to hundreds of LoungeKey airport lounges worldwide at a discounted rate saving roughly £25 per visit (based on £15 fixed price for Curve members per visit Vs £30-£50 on the door for most lounges, for instance, No1 Lounge, Heathrow Terminal 3 costs £40 on the door but with your Curve card it’s £15).

- Curve Customer Protection for up to £100,000 on all purchases

Black card – £9.99 per month

Black card – £9.99 per month

If you don’t have existing gadget insurance, travel abroad a couple of times a year &/or spend a decent amount at selected retailers per month. These are all the benefits:

- 1% cashback at up to 3 retailers

- Fee-free worldwide ATM withdrawal (up to £400 per month)

- £800 gadget insurance (worth ~£5.99)

- Worldwide Travel Insurance giving you £15,000,000 in medical cover

- Curve Customer Protection for up to £100,000 on all purchases

Get £10 free when you sign up using code TEN10 – simply download the app and enter code TEN10

Note: We’ve been given a free Curve metal card to test for 12 months and we’re paid for each sign up using the above code, this doesn’t change what we think of the service and we would still recommend it without this incentive.