Budgeting is boring, right? Figuring out your finances is a long, dull task that few of us are particularly eager to tackle. While we all want to save more money, the idea of going through your spending might sound like a total snooze fest. Rather than doing it all yourself, there are some really decent apps out there that help to make the process easier and more interesting. Here are 12 that you may just want to check out for yourself.

(Note: While some of these are American-made apps, you can switch the currencies on them!)

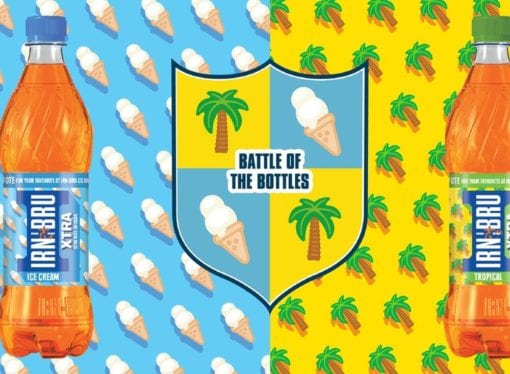

1. GoodBudget (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Here’s an app that takes an old school budgeting style and makes it simple for a modern audience (that’s us). You may have heard about the ‘envelope budgeting method’ before but, if you haven’t, here’s a super quick summary. The method is a way of managing your cash by dividing it into different categories for different things. If you were working with cold, hard cash, you would divide your notes and coins into different envelopes and label them. Since we’re closer than ever to a paperless society, the app is the next best thing.

So, the app helps you to divide up your income into different envelopes for expenses such as bills, the rent, and spending money. It works on Android devices and iPhones, and there is even a desktop version too! What’s more, you can sync your account with someone else’s (say your housemate or partner) so that you can share certain expenses. The basic app is free but you can subscribe to a ‘plus’ version if you want a more in-depth budgeting system.

Download: GoodBudget

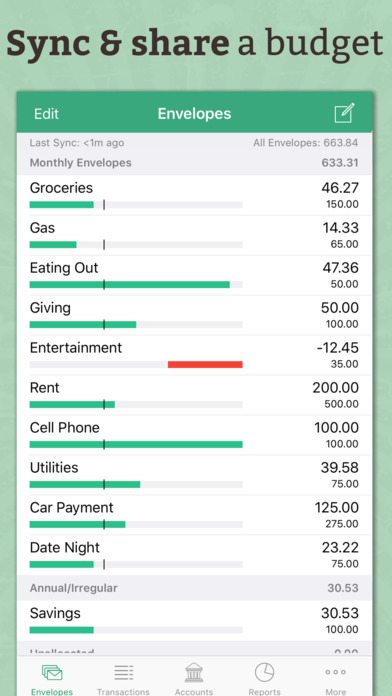

2. Unsplurge (iOS)

(Image: iTunes)

(Image: iTunes)

We all know that saving money can be dreary at the best of times. Let’s face it, there’s nothing interesting about being frugal and missing out on the things you love. Still, most of us have big dreams that we want to save our pennies for. Whether it’s a getaway or some high-tech gadget, there are likely things that you’ve tried (and ultimately failed) to save up for in the past. That’s where the iPhone Unsplurge app comes into things.

Once you’ve got the app, you get to set your goal. Let’s say, you aim to save £1,500 for a trip to New York, for example. Now, each time you save money somehow, you log it into your app and the goal percentage goes up. This app allows you to not only track your own progress but see other people’s targets as well. You can even interact with users and motivate one another to keep on saving!

Download: Unsplurge

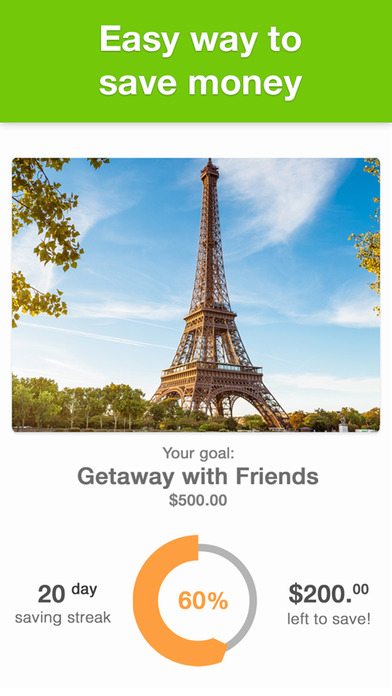

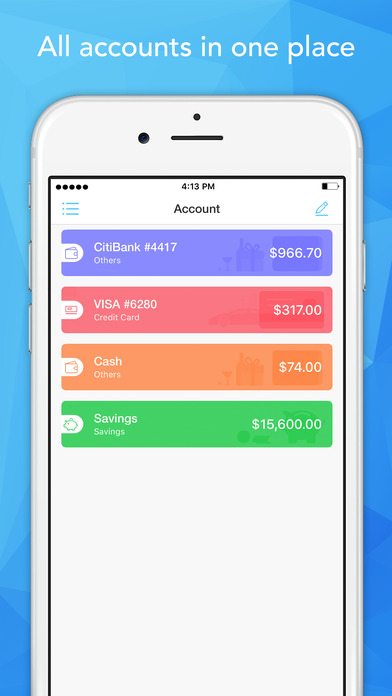

3. Money Dashboard (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Of course, one of the most important ways that you can manage your budget is by constantly checking your bank account (or, more likely, accounts). We’re all guilty of pleading ignorance when it comes to our spending habits. When the ATM asks you whether you want to see your balance, do you fall into a mild panic? Yeah, you’re not alone. Still, if you have any hope of saving money, you need to keep on top of this one.

You can sign up to Money Dashboard online and then download either the iOS or Android app. Once you’ve done so, you can link up all your accounts and see exactly where your money is going. The app groups certain spending habits (such as food, bills, etc.) and show you where your cash goes each month.

Download: Money Dashboard

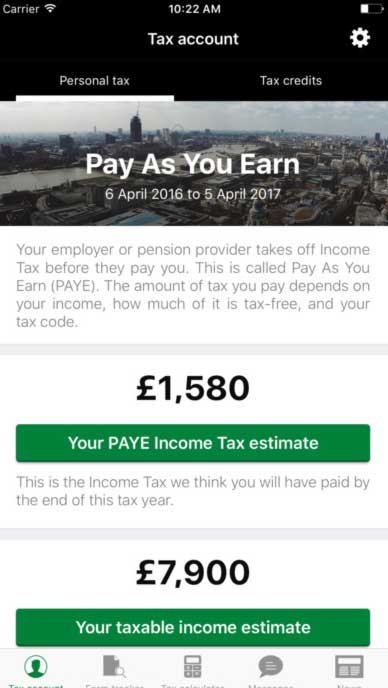

4. HMRC App (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Sick of getting those pesky underpayment letters? Yeah, us too! If you’ve ever been hounded by HMRC for underpaid taxes or the like, you will know what an utter pain in the behind it is. This usually happens when you’re accidentally on the wrong tax code after you’ve changed jobs or got a second job. It’s seriously irritating to be told that you owe the government money when you had absolutely no idea that you’d been underpaying.

Using the HMRC app, you can make sure that you’re on track. The app tracks your income and shows how much you should be paying in Income Tax and National Insurance. What’s more, if you happen to be self-employed, the app also helps to estimate how much your self-assessment bill will be next year. Phew.

Download: HMRC App

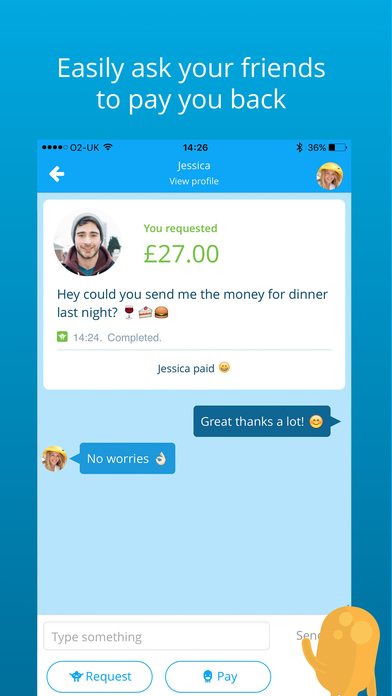

5. PayFriendz (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Let me start by saying, borrowing money from your pals is always a recipe for disaster. If there’s a surefire way to ruin a friendship, it’s by owing someone money and conveniently ‘forgetting’ to pay them back. Don’t be that person, yeah? If you do need to repay your friends, though, here’s a quick and easy way to do it. Rather than messing about with account details and the like, you can just download this free app. Basically, you can add money to it using your debit card and then simply sent it across to someone else with the app in seconds.

Download: PayFriendz

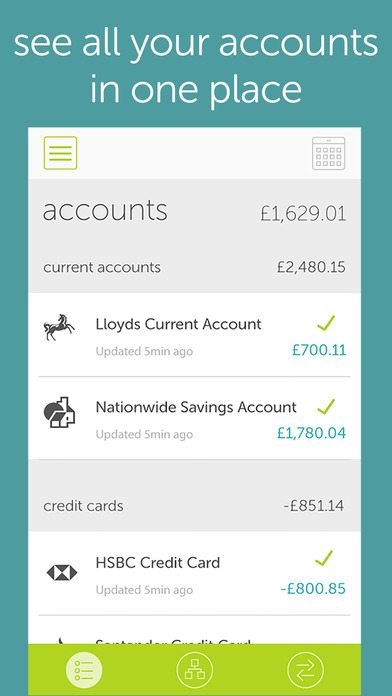

6. OnTrees (iOS)

(Image: iTunes)

(Image: iTunes)

At the end of the month, we’re all filled with nothing short of regret. When you see your bank balance slowly drift back into the minus zone, you may wonder where on earth your money has gone. You’re sure that you didn’t overspend this month and yet your bank balance is telling an altogether different story. OnTrees helps you keep track of where your cash is going on a month by month basis. Once you login to the app, you can view all your different accounts and check out where your cash is going.

Oh, and don’t worry, you don’t have to manually go through your transactions. Instead, the app will sort each payment into a different category so you can see how much you’ve spent on everything from clothes shopping to bills.

Download: OnTrees

7. Wally (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Comparing your income to your outgoings is the only true way to figure out how much money you’re saving each month. Wally allows you to do just that. It monitors how much money in coming into your account and how much you’re spending. What’s more, it uses location services to figure out where you’re spending your cash. (Yeah, it may be a little creepy, but it’s also seriously useful at times.)

That’s not all, though! You can also set yourself financial targets and create a personal month by month budget. If you keep up to date with the app, you could find that it helps you be just a little savvier with your spending.

Download: Wally

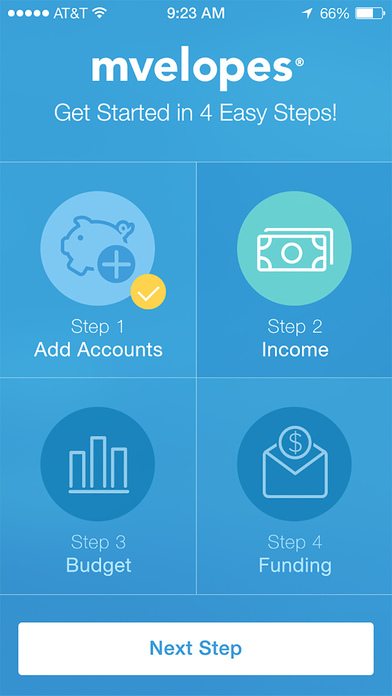

8. Mvelopes (iOS and Android)

(Image: iTunes)

(Image: iTunes)

Much like GoodBudget, this is an app that uses the ‘envelope budgeting method’ and applies it to your current finances. Using the app, you can separate your income into different categories so that you know just how much you have to spend on each thing. In short, that means that you will know how much money you can spend in the pub this month and how much you have to spend on bills too.

So, how does it work? Well, the moment you buy something, take a quick snap of the receipt and upload it to the app. The app will then update your budget and give you updates about how much you have left to spend.

Download: Mvelopes

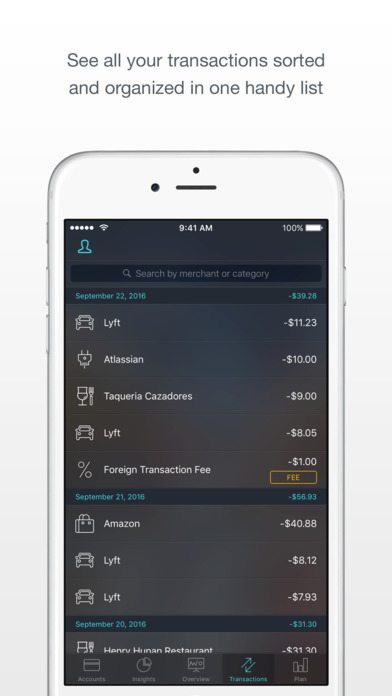

9. PocketGuard (iOS and Android)

(Image: iTunes)

(Image: iTunes)

So that you know how much you have to spend each month, you need to work out what your income is and then take away your expenses, bills, and debts. While that sounds pretty straightforward, it requires a lot of work with the old calculator. PocketGuard makes things way simpler by doing all the hard work for you.

The app links with your accounts and works out how much ‘free money’ you have to spend each month. That means that you will never accidentally overspend and not have enough cash for a pesky bill you just so happened to forget.

Download: PocketGuard

10. Monefy (iOS and Android)

(Image: Google Play)

(Image: Google Play)

Budgeting would be a whole lot easier if we could actually visualise where our cash is going. The Monefy app presents you with an easy-to-understand diagram which sorts your outgoings into helpful categories. What that means is that you can see at just a glance how much you’re spending on everything from coffee to fuel.

While there’s no doubt that this is a pretty looking app (it’s super colourful and has loads of little icons for each expense), it comes with some drawbacks. Basically, if you want to use all the functions, you need to either pay for it or get the ad version of it. Of course, we suggest the latter so that you can save yourself some pennies by dealing with a few little adverts now and then.

Download: Monefy

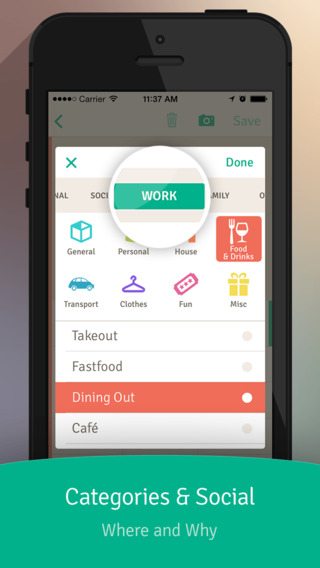

11. Pocket Expense (iOS)

(Image: iTunes)

(Image: iTunes)

Once you’ve downloaded the iPhone or iPad version of the app, you can get started. Each day, you have to log what you spend and where you spend it. (Hint: It may take a while to get into the swing of this, but you want it to become an unconscious habit!)

The app then takes that information and turns it into bar charts so that you can clearly see where your money is going. What that means is that you can review your spending at the end of each month and figure out where you need to cut back.

Download: Pocket Expense

12. Toshl (iOS and Android)

(Image: iTunes)

(Image: iTunes)

This is another highly visual app that you may wish to consider. Once you’ve linked your accounts to Toshl, you will find that it creates charts and diagrams to show you what areas of your life are costing you the most. If you’ve not got a clue where the lion’s share of your money goes, this could be the way forward for you.

As though that weren’t enough, the budget calculator tells you how much cash you can feasibly spend on a monthly basis. (Note: You get to set the limits on this, and so you can choose how much you spend or save!) You can also set it up to get push notifications about bills and other expenses so that you can budget for them ahead of time. The free version of the app is fully functional and useful, but there is also a paid ‘premium’ version if you feel you need it.

Download: Toshl

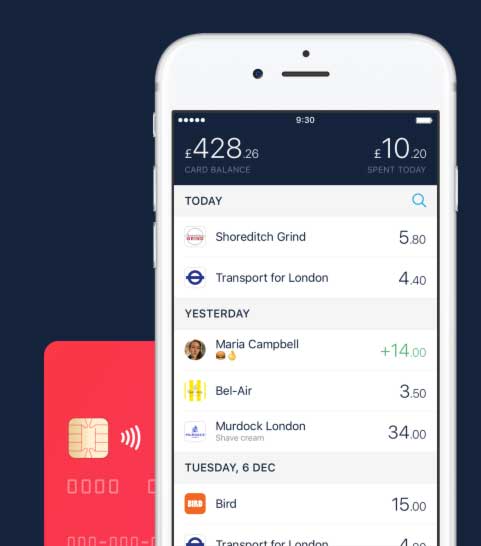

13. Monzo (iOS & Android)

(Image: Monzo)

The app/card we use personally use (10ways admin) everyday. It’s superb and makes money budgeting very easy + allows you to travel around Europe and not worry about converting currency or spending on a card as it is FEE FREE!

View: Read our full review to see why we love it.

14. Revolut (iOS & Android)

(Image: Revolut)

Similar to Monzo in the fact it’s fee free when travelling abroad (there is a limit) but you can instantly convert money into different currencies.

You can also generate virtual debit cards for purchasing on untrusted websites.

Download: Revolut

15. TAXO’D (iOS only, Android Soon)

(Image: TAXO’D)

(Image: TAXO’D)

An app for freelancers to get their finances sorted, quickly see your income, expenses, profit and TAXO’D amount (money owed to Government, update real-time) etc.

Custom-built by the self-employed for the self-employed, no more guesswork. Your income, expenses and real-time tax bill at a glance.

Snap and save invoices and receipts to access again from anywhere.

Download: TAXO’D