If you’re requested to wear a uniform at work and you have to wash it, repair it or replace it then you should be entitled to a partial tax refund.

Hundreds of occupations are valid e.g. Nurse, Police Officer, Builder, Pilot, Blacksmith, Labourer, Motor Mechanic, Fire Fighter, Forestry Worker and loads more.

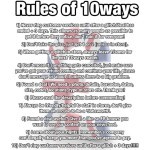

Who can apply? Anyone that meets ALL of the following:

- You wear a recognisable uniform that shows you’ve got a certain job. e.g. a t-shirt/jumper with company logo or a dedicated uniform (think nurses uniform), however, you may still be able to claim if it’s just plain clothing (e.g. your company says you have to wear a black plain t-shirt).

- Your employer requires you to wear it whilst working

- You’re responsible for the purchase, cleaning, repairing or replacing of the item.

- You paid/pay income tax in the year you’re claiming for

Who does this NOT apply to:

- Armed Services – This should be done automatically for all armed service personnel

- Some Police services – You need to check as some forces now automatically claim it

- Anyone that works somewhere that already offers to clean your items for you or has facilities for you to do it (even if you don’t actually use them).

How much can I get refunded?

The standard flat rate expense allowance (FREA) for uniform maintenance is £60 (for 2015/16) – so basic-rate taxpayers can claim £12 back (20% of £60), and higher-rate payers £24 (40% of £60). The £60 is a flat rate, so you don’t need to record and report the individual amounts you spend.

You should be able to claim back at least 4 years worth. Your tax code will be changed for the next year.

Selected specialist occupations will allow you to claim more back e.g. Agriculture Workers (£120), Joiners (£140), Builders (£120), Motor Mechanic (£120), Food worker (£60), Forestry Worker (£120), Ambulance staff (£140), Nurses (£100) etc. (Note these prices are correct at time of writing but may change to ensure you check the HMRC Manual on Gov.UK

You might be able to claim more money back if you can prove your uniform bill is higher.

Notes:

- You can’t claim for the initial cost of buying the clothes, just the upkeep/washing of those items.

- On the forms below you will have the option to claim for other expenses, e.g. professional services, tools & travel

- Other expenditure may apply to your job (e.g. Nurses can claim £12 for shoes, £6 for tights & tax relief on RCN yearly subscriptions).

How do I claim?

Only ever request refunds directly from HMRC (.gov websites). There are lots of scam sites offering to do it for you but they just fill out the same forms you will be doing!

Fill in the P87 form online and either submit it online or print it out and send it to the address on the form/website.

Note: You will need to let them know if you’re claiming flat rate expenses (most likely you will be) if not, you’ll need detailed records of costs. See flat-rate expenses allowed for different occupations.

If you need to check anything (or you’ve previously claimed) then ring 0300 200 3300 – the phone line is open 8am to 8pm Monday to Friday, and 8am to 4pm on Saturday.

Watch out for scammers / companies willing to fill in the forms for you… (please read!)

NEVER use any other service to claim, only go DIRECTLY to the Government website to claim. You will be effectively throwing money away by paying someone else to fill in the form.

Unfortunately, there are lots of newly setup companies with the aim to help you with your claim, in return for cash/part of the refund, when actually all they do is ask you the same questions the form already asks and fill it out for you! Then you end up paying them for it! Don’t do it!