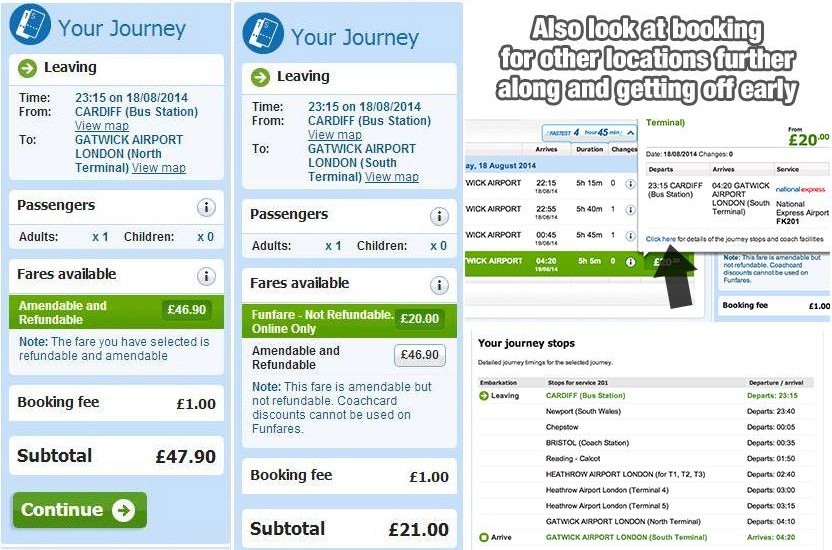

“When I was searching for airport transfers I found that Nati0nal Express (http://10ws.co/1jvxi7m) is charging an extra £26 just to get off at the North terminal at Gatwick as opposed to the South Gatwick terminal, they don’t let you pick the cheaper ticket type.

I saw in a travel forum that Gatwick has a free bus between terminals anyways. Luckily I needed to get to the South terminal so got the cheaper ticket but it’s worth double checking before you buy your bus ticket.

When I booked it says in the small print passengers can request to get off at an earlier stop if the driver agrees. I looked at all the stops between Cardiff and Gatwick (first and last stop) and that whole journey costs £20 at that time and date. Whereas if passengers get off at Bristol, Heathrow or Gatwick North then they will have to pay more! So book for a location further along the trip and get off early.

I have included screen shots so hope this all makes sense I think this page is the best FB page, you do a great job” – Thanks to Toni.

► How do I find the stops?

http://10ws.co/1jvxi7m find the time you want to leave your destination and then pick a route.

Then click on ‘info’ and then click on ‘Click here for details of the journey stops and coach facilities’, this then shows the other stops on the route. Remember you can only get off early so you would need to try and find out where the bus continues to after your stop to see if you can find a cheaper price to then book that ticket. Once you’re on the bus just mention to the driver where you’re going and it will be fine.

If you can’t find the next stop to book for, see the price difference for 1 stop before your stop and see if that price is much different, then look at prices from that 1 early stop to your final destination.

Hope this helps

![Woman finds ‘genius’ way to make money from Tinder [scam]](https://10ways.com/wp-content/uploads/2017/07/girl-makes-money-via-tinder-100x100.jpg)