27th Feb 2015, was a proud day for us at 10ways and also for you – we’re pleased to announce we’ve become corporate sponsors for our MK food bank, meaning at least 1,200 families will not go hungry this year – so thank you on behalf of them and thank you from everyone here.

If you have a local food bank then we urge you to consider donating any surplus food, drinks, snacks etc to them especially if you’ve got surplus from a 10ways deal.

For those wondering only people who have been referred by an official agency (e.g. Doctor, Housing Office, Job Centre, Citizens Advice Bureau etc) can claim a food parcel with a maximum of 5 parcels per year. It’s purely an emergency box, not designed to have relied on long term but to get them out of trouble for 3-5 days.

To find your local food bank it’s probably best to simply google ‘your town/city name + food bank’ as there are so many different organisations that run them.

Thanks again, it really does mean a lot to us here & everyone involved at The Food Bank MK

In 2018 we partnered with Tesla Owners UK & The Christian Blandford Fund to donate 13 RadioFlyer toy Tesla cars to children’s hospices and hospitals across the UK, in 2019 we plan to repeat this.

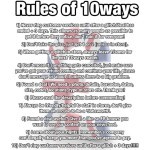

Food Bank Updates

We’ve continued to help fund MK Food Bank

- 27th Feb 2019 – £6000 will be donated

- 28th Feb 2018 – £6000 donated

- 28th Feb 2017 – £6000 donated

- 29th Feb 2016 – £6000 donated

- 27th Feb 2015 – £6000 donated

Toy Tesla Car Updates

- 2018 – The purchase of 13 full priced Radio Flyers Cars (actually we got them heavily discounted so it works out at roughly 40 cars).