If you’re into fashion, frugal finds, or the thrill of beating the crowd to a bargain, the ASOS Sample Sale might just be your new obsession.

This epic online sale has caused a stir across social media — particularly in bargain-hunting Facebook groups — and it’s not hard to see why. Hundreds of items from both men’s and women’s ranges are up for grabs, and everything is either £3 or £5. Yes, really.

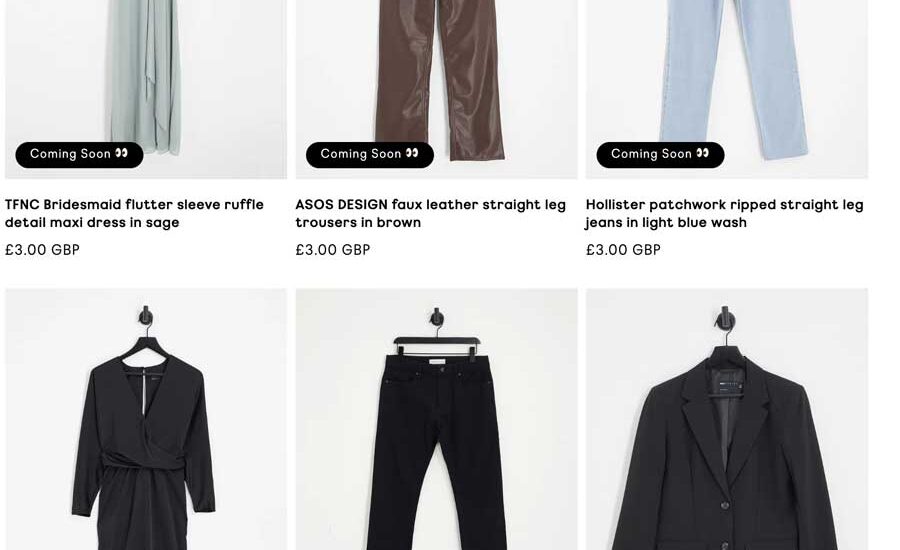

From chunky blazers to ripped jeans, satin dresses, hair accessories, and even stunning bridesmaid gowns, there’s something for nearly every style — and size. To avoid heartbreak and make life easier, filter by your size and by availability > in stock, as things sell out fast.

Some of the standout £3 items we spotted include:

- Maya & ASOS bridesmaid dresses in multiple colours, sizes and fits — including maternity and petite

- Topshop & Weekday jeans

- Satin midi dresses, faux leather trousers, strappy heels & suit jackets

- Hair claws, accessories, and even occasionwear

- Menswear including chinos, slim-fit jeans & formal jackets

⚠️ A word of caution on returns

A few shoppers have reported problems with returns on sample sale items — and there’s a £2 returns fee too. While many items are a steal, we’d strongly suggest only buying what you actually need or know will fit, rather than bulk-ordering sizes “just in case.”

Personally, we would consider skipping the return route entirely and list a few pieces that didn’t work for you on Vinted/eBay etc. Less hassle, no waste, and someone else gets a bargain too.

If you’re planning a wedding, fancy revamping your wardrobe on a budget, or just love a high-street treasure hunt, this is one of the best-value online fashion sales we’ve seen all year.

🛍 Check out the ASOS Sample Sale here — just be quick!

Nothing exciting you? Consider heading over to the ASOS sale instead