Disclosure: We believed so much in Chip that we’re actually investors in their company but like always this doesn’t affect our editorial content.

What does Chip do?

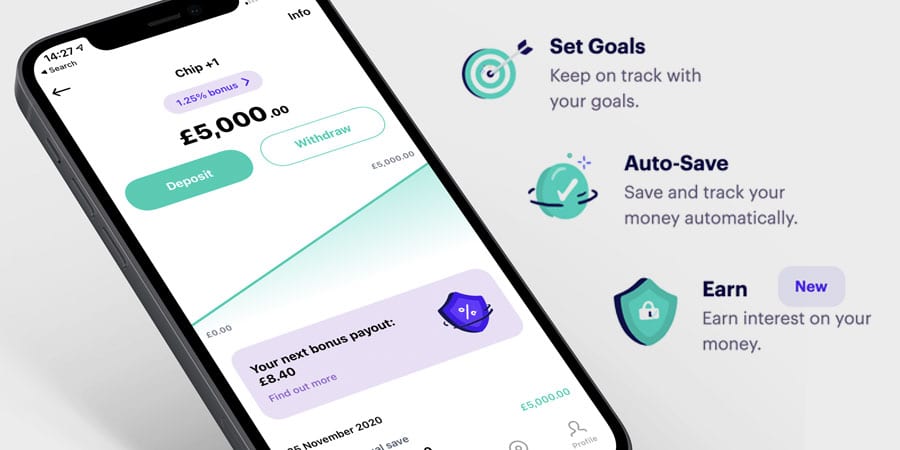

Savings accounts from traditional banks often give pretty poor/awful returns, however, Chip changes that, they provide a savings account app with these key features:

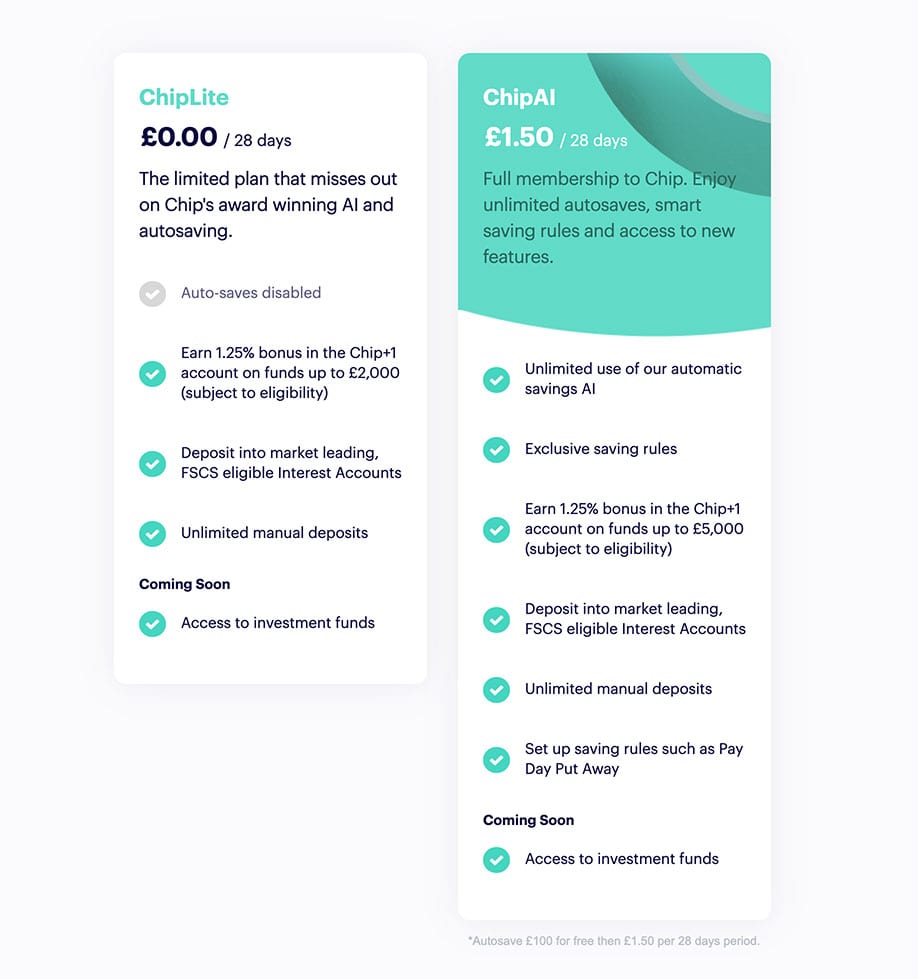

- A high rate (AER) of 1.25%, variable on up to £5,000 [for ChipAI customers who pay £1.50 per month] OR 1.25% on up to £2,000 for £0 per month [for ChipLite customers who pay £0.00 per month]

- [For ChipAI customers only] Artificial Intelligence that tracks your spending habits using Open Banking technology and automatically saves what you can afford to save each month without you doing anything, whilst always ensuring a minimum balance is in your main bank account to cover your normal expenditure and to ensure you have enough to cover all your standard direct debits etc.

- Interest that is paid for every day your money is in the account

- Set goals and automatically split your savings into each goal

Is it safe to put my money in?

Yes, like the big banks, the money your deposit is eligible up to a total of £85,000 by the Financial Services Compensation Scheme (FSCS) which basically means even if Chip went bust tomorrow, the UK Government would protect your money (up to £85,000).

Your money always remains yours and is kept separate of any money owned by Chip.

How do I get the 1.25% deal?

Normally it requires a friend already with the app to refer you, but we’ve secured you a VIP code to save you the hassle and jump past that step.

Simply use code 10WAYS in the home tab after signing up here

How is the interest paid?

Interest is paid into your Chip general account but this does not compound with your savings, so the money is effectively kept separate for you to remove as you wish.

Is the optional £1.50 per month / £18 a year ChipAI fee worth it?

The Auto-save feature is really nice (it basically tracks your bank account to work out what you can automatically afford) and if you have over £3,575 saved (i.e. £1575 over the £2000 fee-free portion) the fee is covered by your increased allowance, then anything between £3,575 and £5000 is a bonus!

Should I stick with the free account or upgrade?

Should I stick with the free account or upgrade?

You can save up to £2,000 for free, so if you have less than £2,000 to save then this is the best value for money but the automatic savings and analysis is decent so it might be worth it for you to pay straight away. Use code 10WAYS in the home tab after signing up here to get your 1.25% bonus

Which banks does it work with?

Bank of Scotland, Barclays, Danske, First Direct, HSBC, Halifax, Lloyds Bank, Marks & Spencer, Monzo, Nationwide, Natwest, RBS, Revolut, Santander, Starling, TSB and Ulster Bank.

This basically means that Metro Bank, Tesco Bank, Co-operative Bank and a few others aren’t compatible yet.

What do other people say?

- Apple App Store Reviews (based on 7,500 reviews January 2021) 4.5/5

- Google Play Store Reviews (based on 2,852 reviews January 2021) 4.3/5

- BEST PERSONAL FINANCE APP – Winner (British Bank Awards 2019)

- Best Banking App 2019 – Winner (World Bank Awards 2019)

- BEST PERSONAL FINANCE APP – Highly Commended 2020 (British Bank Awards 2020)

- CUSTOMER SERVICE CHAMPION – Highly Commended 2020 (British Bank Awards 2020)

I’ve checked some reviews and there are some negative ones, what gives?

So Chip was once completely free (2016-2020) and lots of people signed up to this free system, but as Chip moves to earning money for the features they provide, they introduced a £1.50 fee per month fee for those who want the autosaves and higher savings thresholds.

You can learn more about their pricing and business model here.

Is there a way to pause or stop autosaves?

Yes, there are several ways of doing this within the app.

What about income tax?

You may have to pay tax on any bonus over your personal savings allowance. If you’re unsure whether the total amount of bonus you will receive could exceed any personal savings allowance then you should check with Her Majesty’s Revenue and Customs (HMRC).