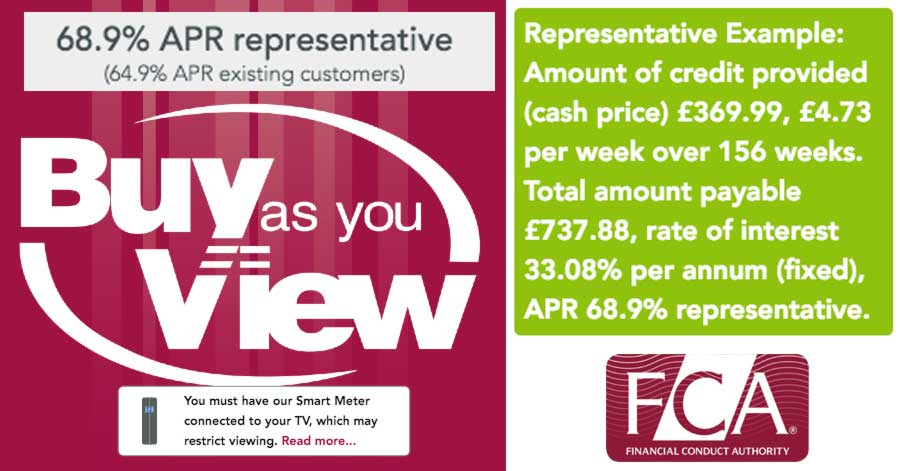

The company that actively promotes a £369.99 TV that will cost you £737.88…. (over 3 years due to the interest rates) has rightly come under fire by the Financial Conduct Authority (FCA) not for that ‘amazing’ deal on the TV but because they were remotely restricting access to their customers TVs if they hadn’t paid on time and due to the lack of clarity of fees and the treatment of customers in arrears.

59,000 customers of the Coventry-based company will be entitled to part of the £939,000 in compensation, the company operates across the UK selling TVs, Furniture and other electricals on a weekly finance payment scheme at 68.9% APR,

Dunraven Finance (owners of Buy as You View) will pay an average of nearly £16 per customer, by adjusting bills or in cash payments. It will contact customers directly however if you’re a customer it might be worth bugging them as I’m sure they would bug you if you under paid!

Chief executive Graham Clarke said:

“We have worked closely with the FCA in recent months to address these issues and I am sorry to any of our customers who may have experienced difficulties as a result of us not achieving the high standards we set ourselves.”

Jonathan Davidson, from the FCA, said:

2 comments“It is important that firms meet our standards, including carrying out proper creditworthiness assessment and making sure that those in difficulty are treated fairly.

“We will continue, when necessary, to take action against inappropriate behaviour.”