This was originally written in 2016 but still in 2023, we see similar scams continuing! Updated: Jan 2023

Various free-watch websites have been going viral over the past few months, often they’re heavily promoted via social media ads.

In reality, it’s technically not a complete scam as you may end up with a watch BUT it’s certainly not free, you will be paying way over the top for the watch and often they arrive damaged or nothing like the original photographed watch.

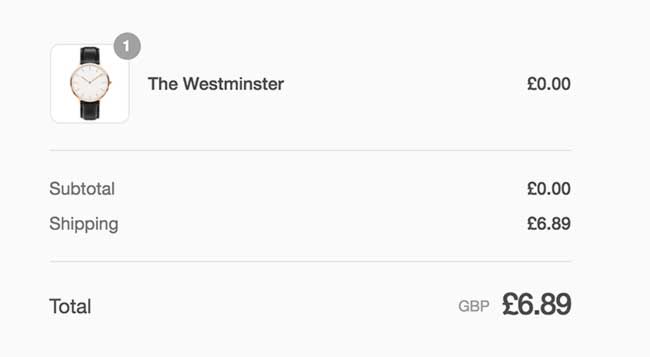

The true cost of the ‘free’ watches

How do we know it’s a scam?

- Often the photos of the watches are edited copies of the originals (e.g. Daniel Wellington designer watches are photoshopped and the edited photos are used)

- The copies of the watches can be found for around £2-£3 on various Chinese or on here. You even get free postage!

- The scam websites never mention the actual cost of postage until you’ve entered your payment details (a typical no-no)

- The Whois data is hidden for the sites, ANYONE could have set this site up and ANYONE could be buying/seeing your details &/or about to send you spam to the email you used! Learn about Alias emails!

- Good news: Photos on the various Facebook pages we’ve seen indicate they buy the above watches on the cheap in bulk, then redistribute them (for a profit) in the UK / US. Note: The Royal Mail postage mark below.

- The photos they use of people wearing the watches are not taken by themselves, they’re copied photos that have had the other brands info removed.

Found this article useful?

You may also like:

- Learn how to spot scams using Google Reverse Image Search

- 13 scams your mates will hate you for sharing on Facebook

- New Tinder Scam

- The £20 Change Raise = Instant Profit Scam