As anyone who has gone through the process of buying a house will know, there are a lot of things to consider before making such a big purchase. It’s not just about finding the right property – you also need to make sure that you’re getting the best value for your money.

If you’re looking to buy a property, make sure you follow these tips to ensure you’re getting the best value for your money for you and your family OR make sure you’re buying into a house that will appreciate faster than other homes you’re looking at:

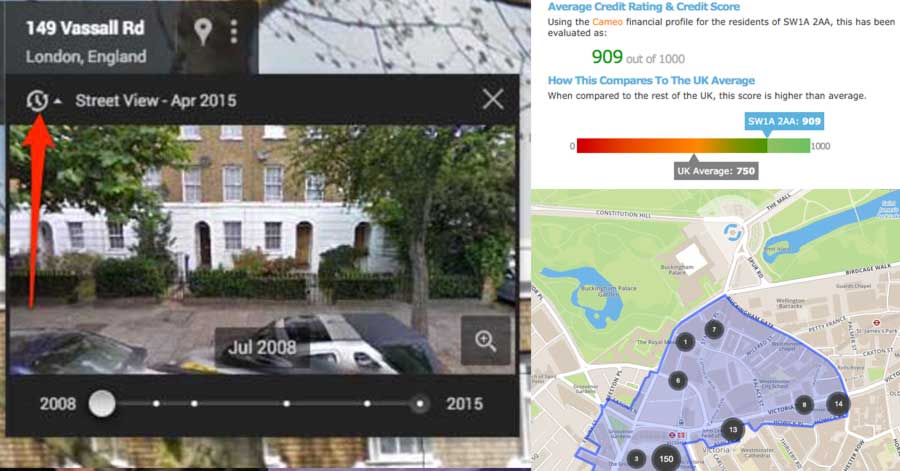

Check the historical price of the house

For instance, on this example, it’s listed on Rightmove at £265,000 but originally it was listed at £325,000, so you now know the price history and how long it’s been on the market for, to get this information on Rightmove use the Google Chrome Extension Property Log. This knowledge can really come in handy when negotiating, especially if the price has risen or the house has been on the market for a long time.

Check the historical prices of other similar homes in the local area

This will give you an indication of how much the property you’re interested in is likely to appreciate over time. To find this search Zoopla for historic prices.

Get the property properly surveyed / checked with a builder

This will give you an accurate idea of its worth and can help you negotiate a better price, if you’re planning work get a builder to come with you as well.

There are various options on what level of survey you can have, these vary from ~£500-£1500 but are well worth it, especially if a survey finds an issue which might cost ~£10,000 to fix, you could then push for a discount on the house to match the repairs.

We recommend you go with an RICS Accredited Surveyor

Check planning and council websites so there are no shocks!

Any upcoming changes to the area should be taken into consideration before finalising your decision. A new business park, shopping centre or roadway could bring more foot traffic and boost business, but a construction project might cause increased noise and dust levels that are detrimental to your health for several years. The best way to find this information is by checking your local authority’s website or having your solicitor conduct searches during the buying process; the latter will also uncover any upcoming Council Tax charges.

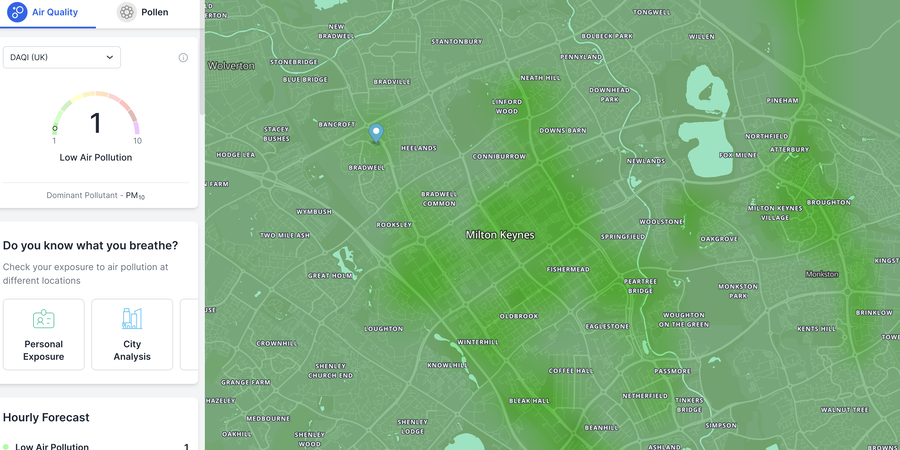

Check flooding, pollution and traffic

Knowing if the house is on the school-run route, his heavily polluted in the mornings or has flood history gives you better negotiation power.

- Check Google Maps to see how local traffic is handled locally – check peak times by changing the time

- Check Environment Agency for Flood Details

- Check Breezometer to check pollution levels

Check the crime rate, insurance costs, and neighbours out

We have a handy guide on 10 ways to check if a house is right for you + find out details on the area, crime rate, neighbours etc

Check the schools (even if you don’t have kids)

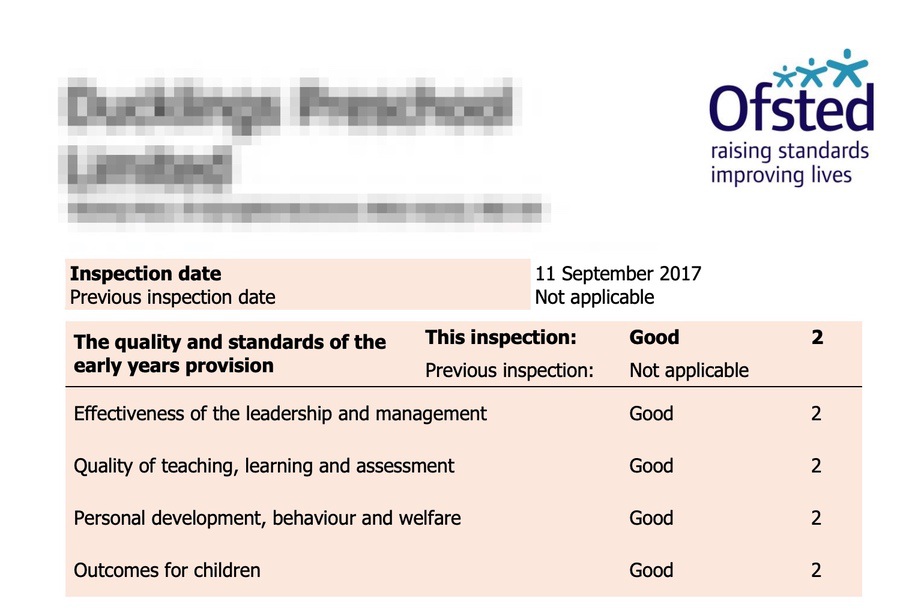

Areas with schools that have outstanding OFSTED reports are generally going to be more valuable, people will fight over homes in key areas, in fact we’ve seen people buy second homes just to get their children into good schools! So knowing this could help you avoid an overpriced area or give you grounds for negotiation if you don’t have children etc.

Look for signs the area is going to improve

Moving into an area that is on the up might be something that appeals both financially but also for better living conditions whilst you live there, some signs this is happening is:

- New bus, train or transport links being built or planned (check local news/council websites etc)

- Lots of house building works/improvement going on, e.g. with workmen, skips or scaffolding visible (simply go on a drive around)

- A high proportion of high-quality restaurants, independent retailers, and high-quality shops (check TripAdvisor and go and walk around the area)

- New estate agencies opening-up (spot this on your walk around)

- A high proportion of people are in their twenties or thirties (walk the area, chat with locals in the street etc)

- New schools planned

Double-check the travel times for work

If you’re moving out of area double check your travel distances and the potential increase in costs.

Understand the chain and situation of those you’re buying from

Know everyone’s position as this could be in your favour if someone is pushing for their dream home and want/need the chain to speed up. We’ve seen people drop the value of the house by £20K just because they want/need the chain to proceed.

Don’t rush into anything

Take your time to consider all of your options and make sure you’re making the best decision for you and your family.