We all want to save money… but that doesn’t mean that we can’t have fun along the way. Cutting back shouldn’t mean missing out. That’s why you should be smart when it comes to how you save. With that in mind, let’s take a look at just 10 game-changing ideas that will save pennies without making your life uber boring. You’re welcome.

1. Get rewarded for walking

>_Any of our London sweatcoiners have issues with the Northern line over the last couple of mornings? There's an app for that…😉🤭👟 pic.twitter.com/x8nU6vZNUT

— Sweatcoin (@Sweatcoin) July 9, 2019

We all know that we should be more active. However, did you know that you could literally make money by walking. One of the best money-saving ideas (that also happens to be a health hack!) is to get Sweatcoin (or use this link for a free bonus). The app works with your smartphone to figure out how many steps you’re taking and gives you coins in return. You can either exchange these coins for real-life money or use them to get discounts on products, apps and more.

2. Quit using contactless

Yes, contactless card payments are a part of everyday life now. However, they have a couple of major drawbacks. For one thing, you have no idea how much money you’re spending when you start using this system. Many people fail to even look at the amount displayed on the screen before tapping their card. The money can sometimes take days to come out of your bank. That may mean that you think you have more cash than you do.

3. Attend pub quizzes

It’s time to put on your quizzing hat! If you’re looking for a cheap and cheerful way to socialise with your pals, a pub quiz could be the answer. While these takes places at pubs (obviously!), you’re likely to drink less since you will be busy answering questions. There’s also the fact that you could win prizes and many offer free food to entice you in. Score.

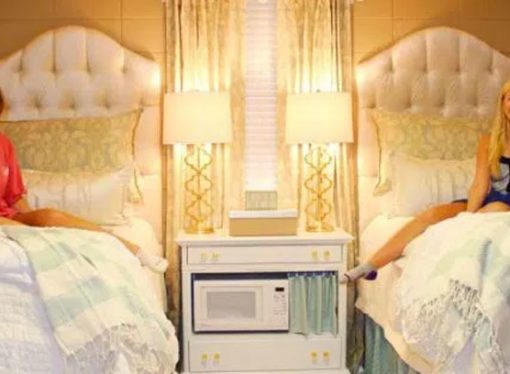

4. Learn to love your home

Think staying in has to be boring? Think again. One of the best ways in which you can save yourself some pennies is to learn to love it. Spending a little time to make your home comfortable and make sure that you enjoy the space is the only way to go. That way, you will look forward to evenings in watching Netflix, playing games or simply reading.

5. Follow brands on social media

If you’re looking for a quick way to save money, one thing you can do is follow the brands you love on social media. For instance, if you always go to the same restaurants or pubs on a weekly basis, giving them a ‘like’ online could do you a major favour. Much of the time, these businesses put out special deals via Facebook or Instagram. With that in mind, you could be the first to know about discounts and offers.

6. Sign up to mailing lists for freebies

When you’re out and about, it’s always a nice treat to have a freebie. Many companies will offer you a reward simply for signing up to their mailing list. With that in mind, before you head out for a few drinks or even a meal, you should quickly search online for these deals. For example, you can sign up to Fuller’s for a free drink or Vintage Inns for a free pudding. Check out what the places in your local area have to offer. You won’t regret it.

7. Get cheap leftover food

https://twitter.com/TooGoodToGo_UK/status/1158296270932520966

Rather than splashing out on a takeaway, why not nosh down on some leftovers instead? The Too Good To Go app could be the answer you’ve been looking for. The app partners with restaurants and cafes in your area so that you get first dibs on their leftovers. While you don’t always get to pick what you eat, portions start from around £1.69. You order in advance on the app and then pick up your ‘magic box’ of food at the end of the day.

8. Eat less meat

Spoiler: Meat is seriously expensive. If you want to save yourself some money, why not consider cutting back. You could go ahead and try #MeatFreeMondays or commit to only eating meat a couple of days a week. When you do your main food shop, you should notice that this small change to your diet makes a big difference to your bank balance.

9. Look for free activities

Having fun doesn’t have to cost money – not always, anyway. One of the best ways you can curb your spending is to look for free activities. For example, you may want to try GeoCaching, which is essentially a large treasure hunt you can play on your phone. Get creative and think about things you can do that don’t cost you pennies.

10. Get free coffee at IKEA

Heading out for a day-trip to IKEA? Here’s a quick and easy hack that you need to know about. Why not sign up for a Family Card online first? The loyalty scheme entitles you to a free cup of tea or coffee anytime Monday to Friday. That means that you don’t have to splash out to get that caffeine buzz that you crave. What more could you want?