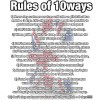

When you’ve just started university, whether away from home for the first time or after a gap year it can be easy to get carried away and spend more than you expected.

Here we share 10 of the most common ways students waste money:

1. Eating out & buying poor quality food

On average students eat out once a week on top of what they already buy to eat at home. Restaurants prices are well known to be overpriced and many market specifically towards young people so cut back on buying food especially if you can make it in a microwave for a fraction of the price.

Spending £5 on a Boots meal deal when there’s nothing healthy about it might seem like a great thing (Boots meal deals are the best) but if you only get two hours’ worth of food this doesn’t equal good value for money; getting some fruit, vegetables or salad will keep you full until dinner time and won’t cost you nearly as much.

Consider all the best practices when it comes to making food at home; bulk buying with a trusted/reliable friend to lower costs and sharing the responsibilities.

2. Missing lectures

On a rainy miserable day at some point in your university life, you will calculate the cost of each lecture and you will be SHOCKED at the true cost for each hour of education! Before you regret missing a bunch of lectures consider simply attending them all! It’s easy to sit back in your newfound freedom and realise nobody will likely tell you off if you don’t attend but the whole point of you going to university is to improve your chances in the future.

3. Buying coffee

It takes hardly any time to make a cup so never buy something you can do yourself for less money and more time-efficiency. Grab yourself a reusable cup and DIY your coffee intake. Consider: 10 ways to secure free/discounted coffee when out of the house

4. Getting drunk (<insert other substances>) every other night

Not only is it bad for your health but also bad for your bank balance! Pre-drinking is a good way to cut down on the expense, especially since most supermarkets will be dramatically cheaper than even the student union bar. Be cautious of nights out the night before lectures, as the knock-on cost of getting drunk can lead to a bigger expense the next day.

5. Don’t buy rounds unless you have trusted friends

Another thing, don’t buy rounds on a night out as by the end of it you’ll regret it; instead, plan who owes what and then buy your own throughout the night. It might feel odd especially if you’ve come from ‘home’ and always bought rounds with your mates. Obviously, if a small group of trusted friends and you do this it’s less likely to go wrong but there will generally always be one person that is left out of pocket or one person that tries to avoid paying for the round!

6. Going home at weekends on trains or coaches

If you plan to go home plan it well in advance as a return train ticket can cost you a decent chunk of your weekly budget so getting a cheap ticket in the future is worth planning for. If you travel from home each day getting a weekly travelcard will likely save you money especially if you make use of your student travel card.

7. Not learning how to cook for yourself in your own time

This is a skill that will serve you well throughout university and beyond! There are always recipe books in the library if you’re looking for ideas or just browse Google/Pinterest/TikTok etc – there’s no excuse not to be resourceful when it comes to food.

Remember to check your cupboards before you head off to the supermarket and plan your food out. It’s easy to go off track and buy something you were going to make anyway, only to find it later in the cupboard.

Also ensure you’re aware of the great ways you can bulk your food out (so it gives you more for your money) with pulses, beans, rice, pasta, breadcrumbs and frozen veg.

There are several popular books for students but equally, consider learning the basics on YouTube or from family/friends. Finally ensure you properly label any leftovers so you don’t end up weeks later binning a load of previously good food.

8. Failing to budget and consequently living off scraps at the end of the month

When your money has run out, this is a fail-safe way to waste money that you could have easily avoided. Budget Budget Budget! It will take you maybe 1 hour to do but will save you endless future headaches! Always speak with family if you’ve made a financial mistake, don’t make it worse by getting into debt.

Once you have little money you may revert to living day to day and the problem with this is it can lead you to spending more money buy buying from local shops instead of by bulk buying at supermarkets etc.

9. Renting accommodation without thinking about the location, transport links, noise or crime rate

Living far away from university can be costly in both travel costs and rent so always look for bargains around your university beforehand but equally, you need to also factor in the cost of accommodation and consider being further away from university to avoid the rip off landlords and find someone more reasonable.

Taking the first thing that comes up on accommodation websites just because it’s there or costs more to get exactly what you want! Always plan ahead where possible especially if it means saving yourself some money at the end of the day.

10. Be sure your friends/housemates are actually people you trust

We’ve seen (first hand) friends/housemates stealing, not paying their fair share, heating their bedrooms with hair-dryers, refusing to buy a round of drinks after they’ve had 7 drinks from others in the round or bringing people into the house that then damage the house meaning you all lose your deposit.

It can be hard to know if you’ve got trustworthy friends/housemates until it’s too late but just try and bear these points into consideration beforehand. If you do have good trustworthy housemates then always buy in bulk, contribute for things like ketchup, milk etc etc. Always speak with one another about bills and always think before you act – what will happen? Is this fair? What precautions can we take to avoid arguments or problems later on?

If problems arise, always remain calm and non-confrontational while coming to a solution. Don’t let money issues get out of control as it could cause relationship breakdowns both inside the house and outside.