Saving money is hard. No, seriously. If you’ve ever tried to make some serious savings, you will know that it’s anything but easy. Luckily, there are some apps that you can use, which will help you along the way. Here’s what you need to know.

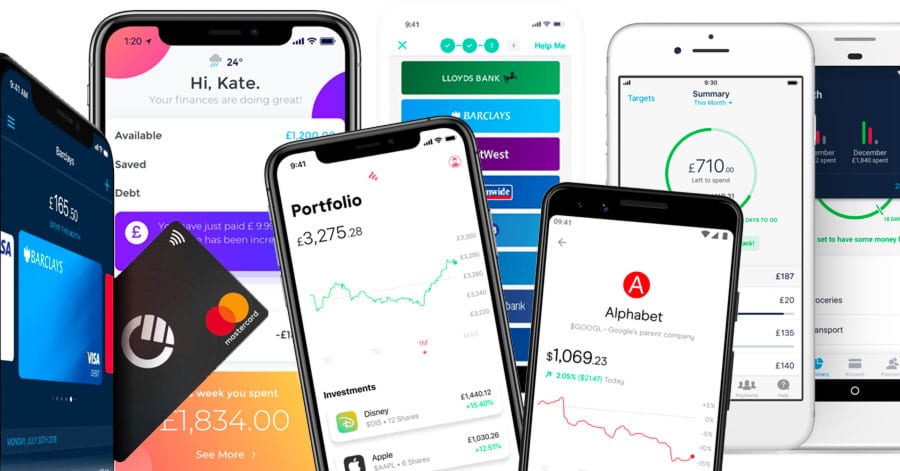

Budgeting Apps

First up, let’s take a moment to look at a couple of great budgeting apps. Managing your money can be tricky when you’re not keeping track of it. These two money-saving apps will help you with just that problem in no time at all.

Emma

Happy Pay Day Everyone! #FridayFeeling pic.twitter.com/WAQyE3R0ZY

— Emma (@emma_finance) June 28, 2019

One of the quickest ways to zap your finances is by having useless subscriptions. If you’re not in the habit of regularly checking your bank, you could be paying out for things that you don’t even use. The Emma app is helpful when it comes to sorting out this problem.

Basically, you link all of your current accounts to this app and then it does the hard work for you. The app will help you pinpoint any subscriptions that you’re not currently using and cancel them. It also allows you to set budgets and manage your money in general.

Download Emma here

Cleo

https://twitter.com/alexis_r_jared/status/1146065884110135296

For some of us, finding out about budgeting can be a massive headache. It’s no fun. Cleo aims to change that by giving you helpful personal finance information in message format. That means that learning about how much money you can spend couldn’t be easier.

Again, you will need to link your banking accounts before you get started. When you’ve done that you can talk to Cleo through Facebook Messenger and get the help and advice you need. The AI bot will give you advice on how you can reach your budgeting goals.

Download Cleo here

Chip

YOU CAN NOW CONNECT ANY BANK TO CHIP!! At ChipHQ we're already connecting up our @RevolutApp #rainbow cards ❤️ pic.twitter.com/ko0g8BEzcK

— Chip (@Get_Chip) July 5, 2019

Chip connects with your bank accounts and works out how much you can afford each month to save, it then automatically saves this into an easy access (3 day) account with up to 5% in interest!

Download Chip here

Online Banking Apps

Confused when it comes to ‘traditional’ banking, we might just have the solution. Online banking apps have seriously taken over and it’s clear to see why. These apps make banking simpler than ever and allow you to have more control over your money. With that in mind, let’s take a look at two of the best options out there.

Monzo

Which emoji best sums up your financial life right now?#WorldEmojiDay pic.twitter.com/XWFQnhT1gi

— Monzo 🏦 (@monzo) July 17, 2019

Have you heard of Monzo yet? When you apply for an account, you get a dedicated debit card, which works alongside it. You can top up the card as much or as little as you want using your current account. Each time you spend money on the card, you get a notification on your phone and it even categorises how your spend your cash.

It doesn’t end there. You can also set budgets for yourself using the app. For example, you might want to set an ‘Eating Out’ limit. Doing so will help you to monitor how much you tend to spend when it comes to eating and drinking in restaurants and bars.

If you’re someone who loves a good holiday, you will adore Monzo. One of the biggest selling points that this banking app has to offer is the fact that you can use it anywhere in the world. The card gives you Mastercard rates of currency conversion which could mean that you save a whole load of money when you’re abroad. Neat.

Get Monzo here (or get a free £5 when you join)

N26

https://twitter.com/N26UK/status/1148225228113420289

Another online bank that you should have heard of is N26. This one has recently launched in the UK and works in a similar way to Monzo. Plus, as a fun added bonus, you can choose what colour debit card you want when you sign up.

Arguably, one of the most useful features of the N26 account is ‘spaces’. These are basically sub-accounts where you can save money. For example, you may need to set aside a certain amount for bills each money. You can create a space for that. Equally, you may wish to save money for a new bike. You can also make a space for that.

Having separate sub-accounts where you can save your cash helps you take real control when it comes to your finances. When you have moved money from your main account to one of these spaces, you’re no longer tempted to use it. Out of sight, out of mind.

Get N26 here

Curve

We are interrupting your feed to announce that our 𝟭% 𝗜𝗡𝗦𝗧𝗔𝗡𝗧 𝗖𝗔𝗦𝗛𝗕𝗔𝗖𝗞 is now 𝘂𝗻𝗹𝗶𝗺𝗶𝘁𝗲𝗱!! 🤑🌟

6 retailers of choice for Metal Card users and 3 retailers of choice for Black Card users. Time for an upgrade? 😎 pic.twitter.com/7Tu1HCJ68p

— Curve (@imaginecurve) June 13, 2019

Curve allows you to go from several bank/credit cards to one, it also allows you to get 1% cashback at up to 6 retailers and provides loads of other useful features including 0% fees on foreign purchases and the ability to swap the card you’ve purchased with up to 14 days after purchase!

Get Curve here (or get a free £5 when you join here by clicking that link and entering code 6DG3WJLN when you sign up)

Shopping Apps

Are you a total shopaholic? If you’re having trouble saving money because you love nothing more than spending it, we hear you. It’s a pain. Luckily, there are a couple of apps that could help. Using these will help you save money even when you’re spending it.

mySupermarket

Thursday Thoughts 🙂 pic.twitter.com/MuxZ5kRjb0

— mySupermarketUK (@mySupermarket) August 9, 2018

Let’s face it, food shopping can be quite dull. Spending your hard-earned cash on a load of necessities doesn’t feel great. But you have to do it. So, one of the savviest ways you can save money on your shopping is to compare and get the best deals.

You might already be familiar with the mySupermarket website. It allows you to compare how much certain products cost at various shops in the UK. The app works the same way, which is why you should 100% download it right now. Simply search for items and see where you can find them at the lowest possible price.

Download mySupermarket here

Idealo

Which are the best and worst months to buy all your travel essentials? https://t.co/1ry5Z5xfUW pic.twitter.com/AXRupvxMAQ

— idealo_uk (@idealo_UK) July 9, 2019

Thinking of treating yourself to something online? Before you hit that ‘buy’ button, you need to make sure that you compare the prices ahead of time. You can search for any items using the Idealo website to find the cheapest offers. When you have completed a search, the site will give you a list of places you can buy the product.

If that sounds good to you, you have two options here. You can either use the search function in the browser version of the site. However, you can also get the app for both Android and iPhone, which means that you will use it more often. Win-win.

Download Idealo here

Investment apps

Investing sounds scary and expensive and it can be but there are a few great platforms available for those who want to take more of a risk with their money.

FreeTrade

ISAs are now free on your app until late 2019 💸

Just tap on your Profile tab to open one. pic.twitter.com/xVgNvluV5O

— Freetrade (@freetrade) July 19, 2019

The clue is in the name, it allows you to freely buy and sell stocks and shares without any commission or fees! There are a few limits but it’s a worth contenter for our top app recommendation of the year. Of course, your money is at risk with all investments so only ever invest money you’re willing to lose.

Download FreeTrade here or click here for a FREE Share (worth up to £200) – only a certain amount available so try again later if it’s not working

![[Updated] All the free gifts for NHS / Emergency staff fighting Coronavirus on the frontline](https://10ways.com/wp-content/uploads/2020/03/miso-100x100.jpg)