The simple answer: It depends on your circumstances but at least 3-4 weeks worth of outgoings

What most [sensible] people try to have:

- 3 months worth of outgoings (enough cash to cover rent, food, transportation, heating, bills etc) in an instant access savings account (that you can transfer from immediately)

- 3 months worth of outgoings (as above, available instantly)

+ 3 months worth of invested longer-term savings accounts / bonds / ISA etc (able to transfer from within 1-7 days) - 3 months worth of outgoings (as above, available instantly)

+ 9 months worth of invested (as above)

Obviously, if you’ve got children, animals, other responsibilities you will have to factor those expenses into your 3 months worth of outgoings.

Why would I need one?

- You lose your job

- A family member becomes very ill and you’ve got to look after them

- An emergency happens abroad and you’ve got to travel somewhere urgently

- You’re involved in an accident and can’t work

- You receive an unexpected bill

- You have a car crash with an uninsured driver & for some reason, your insurance company isn’t saying you were covered

- You get arrested for something

- Your boiler stops working

- You get a flat tyre and need a replacement

How do I work it out?

How do I work it out?

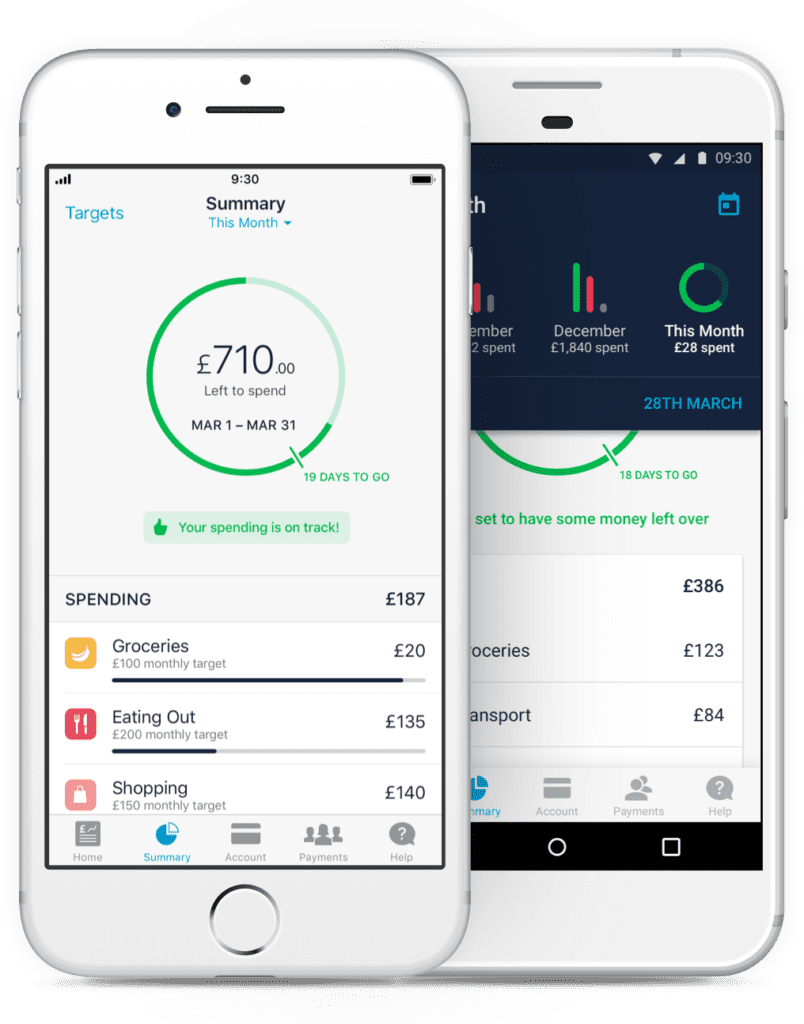

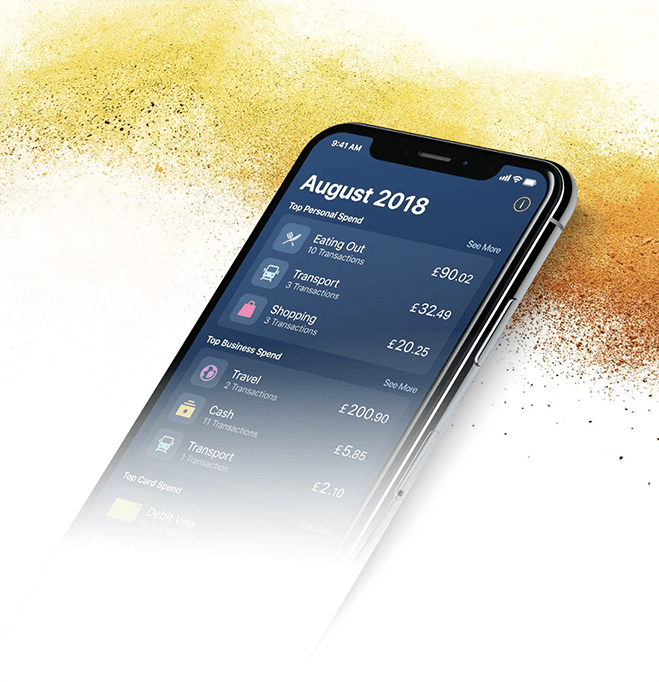

- Get your bank statements out (or use a banking app like (ads) Revolut/Monzo that are largely superior to traditional banks as they automatically work out what you’re spending and where)

- Add up everything that you need to live on (rent, heating etc)

- Write down this number

- Then look back at the past 0-12 months worth of statements (or just sit and think about it) and individually write down the other essentials you’ve had to purchase (e.g. new tyres for car) & divide those figures by the amount of months you expect between a repeat purchase, for instance, most people won’t change tyres every year but you may change them every 2 years, so divide the cost of 4 tyres by 24 months.

- Also, repeat the above step but think of things you know you will need to repair/replace at some point in the near future

- Add those numbers all together + the numbers from Step 3 & you’ve got your monthly outgoings

- Multiply this number by the number of months you want your emergency fund to cover (e.g. 3 months) & that is your figure

- Save this figure and don’t touch the money, have it ready but don’t touch it unless you need it (buying clothes, going out for drinks etc should never be an excuse to touch the money).

I’ve got debts should I still have an emergency fund?

We cannot give financial advice and it will depend on your circumstances but generally, you will be better off trying to get rid of any debts before you have the luxury of saving money, however it might still be worth keeping some money back just in case you have other real emergencies that you need the money for, especially if you risk going further into high-interest debt to cover it.

Where should I store my money?

Information is correct at the time of writing, you should do a full comparison of all options before proceeding, this is not financial advice.

Ideally, you want it within fairly easy reach (max of 2-3 days to access it). Three apps we personally use (and have invested in as we believe in them) are:

- Monzo – Offering 1.02% Gross Interest (paid monthly)

- Revolut – Offers up to 1.35% annual interest paid daily

- FreeTrade – offers £0 commission stocks and share trading + ISAS

- Chip – that offers an alternative to savings accounts that automatically saves your spare money

Should I have a ‘rainy day’ fund?

Read this Is having an ‘Emergency Fund’ enough? Should I have more ‘funds’?