Odeon have launched a ‘See 3 awards films and get the 4th free’ promotion.

You basically exchange 3 Odeon ticket stubs for a free cinema ticket (to one of the selected films below) – so theoretically, you could ask people for theirs as they are leaving…or quickly go around and pick up any left by the bins etc, but obviously don’t do that as it’d be against T&C’s…

Tickets can be collected on multiple films per day, but must be for separate screenings.

The official ‘How does it work’?

1) Pick up one of our awards ticket wallets in cinema.

2) See 3 of our 17 awards films before March 31st 2017

3) Collect your ticket stubs.

4) Exchange your 3 tickets stubs and wallet for a free 2D ticket at the box office or retail counter.

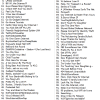

Films you can collect ticket stubs for + the 4th free film options:

- La La Land

- A Monster Calls

- Manchester By The Sea

- Billy Lynn’s Long Halftime Walk

- Lion

- Jackie

- 20th Century Women

- Silence

- Hacksaw Ridge

- Miss Sloane

- The Founder

- Fences

- Moonlight

- Loving

- Gold

- Toni Erdmann

- Hidden Figures

The offer is valid from January 1st 2017 to the 31st of March 2017. Tickets must be collected for performance between Jan 1st and March 31st.

Which tickets are excluded?

Basically only fully priced tickets are eligible for this promotion. So Limitless card tickets, Meerkat Movies, Tesco Clubcard, Times 241 or any other promotional offer are excluded.

Full details + T&Cs on http://www.odeon.co.uk/offers-and-promotions/see_3_awards_films_and_get_the_4th_free/443/