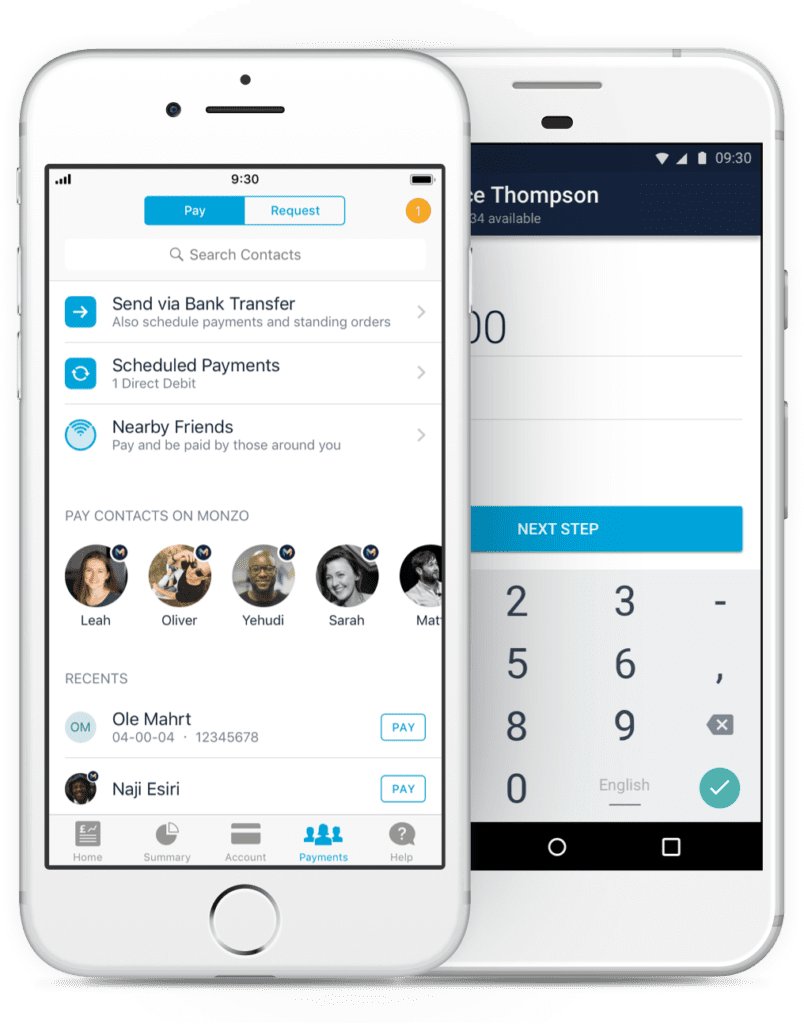

Monzo saw a victory over all other banks in a recent poll that saw them score a massive 78% for their features and usability score on their app, which for us isn’t a surprise (we’re investors and longtime Monzo lovers/users).

“55,000 people open a Monzo account every week”

The poll asked members who access their current accounts via an app to rate their bank based on the following criteria:

- Features: Does it have more than just basic transactions, e.g., budgeting and spending categories?

- Usability: How easy is it to use? Can you do everything you want via the app?

The June 2019 poll that was completed by 5,052 members of the website Moneysavingexpert put Monzo ahead of all the major banks including Barclays (57%), Lloyds (49%), Natwest (47%) and FirstDirect (28%)

What new customer deals do they currently have?

A Monzo spokesperson said:

“Monzo wants to make banking easier for everyone, so we’re delighted that our customers have chosen us as their top banking app for features and great usability.”

But why is Monzo so good…?

- Automatic Budgeting (budgeting is boring but Monzo make it easy)

- Saving pots – Gives you easy access to instant access savings accounts

- Notifications for each purchase

- Withdraw up to £200 abroad every 30 days for free (there’s a 3% charge after that).

- They don’t add any fees or charges for spending with your card, and we don’t mark up the exchange rate.

- Ability to quickly split the cost of items with friends and family

- Request money from anyone with a URL

- List continues below….

- Apple / Google Pay

- Transaction history with map, logos and simplicity

- Decent support if anything goes wrong

- They’re fully FSCS accredited so your money is protected up to £85,000.

- Instantly block and unblock your debit card from the app

- Simple account switching

- Flexible Overdraft if you want it (fees apply).

- Joint Accounts available